About us

Contact Us

Contact Us

Contact Us: Coopbank: “Empowering Community Transforming Lives!”

Contact Information

Contact us for any questions about your account, digital banking services, or financial solutions. We’re ready to assist by phone, email, or at your nearest branch.

Send us your enquiry

Send us your question, complaint or anything...

Get In Touch

Shariah Advisory Committee

Shariah Advisory Committee

Sheik Salih Nur Ahmed

SAC Chairperson

Ustaz Kamil Shemsu Sirai

SAC Deputy Chairperson

Dr.Kamal Haji Galato

SAC Member

Dr. Mohammed Salih Jamal

SAC Member

Dr.Jibril Qamar Adam

SAC Member

Sheik Jamal Aliyi

SAC Member

Media Gallery

Media Gallery

Coopbank Unveils Michu 2.0: Transforming Digital Lending

Coopbank celebrates 18th anniversary, marks another milestone in fixed asset formation

Coopbank is celebrating its 17th Years anniversary

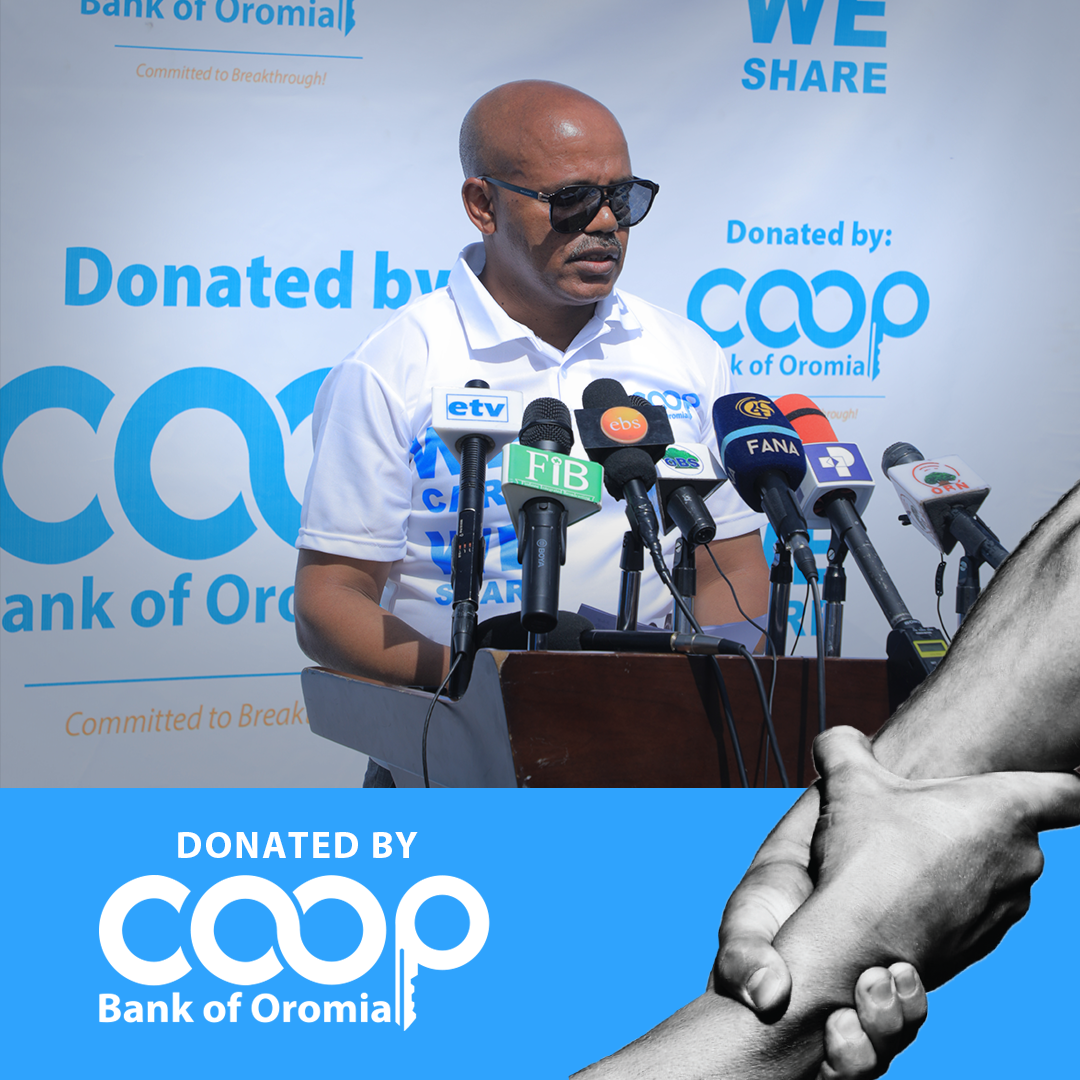

Coopbank delivers donations to drought victims in different Oromia Zone's

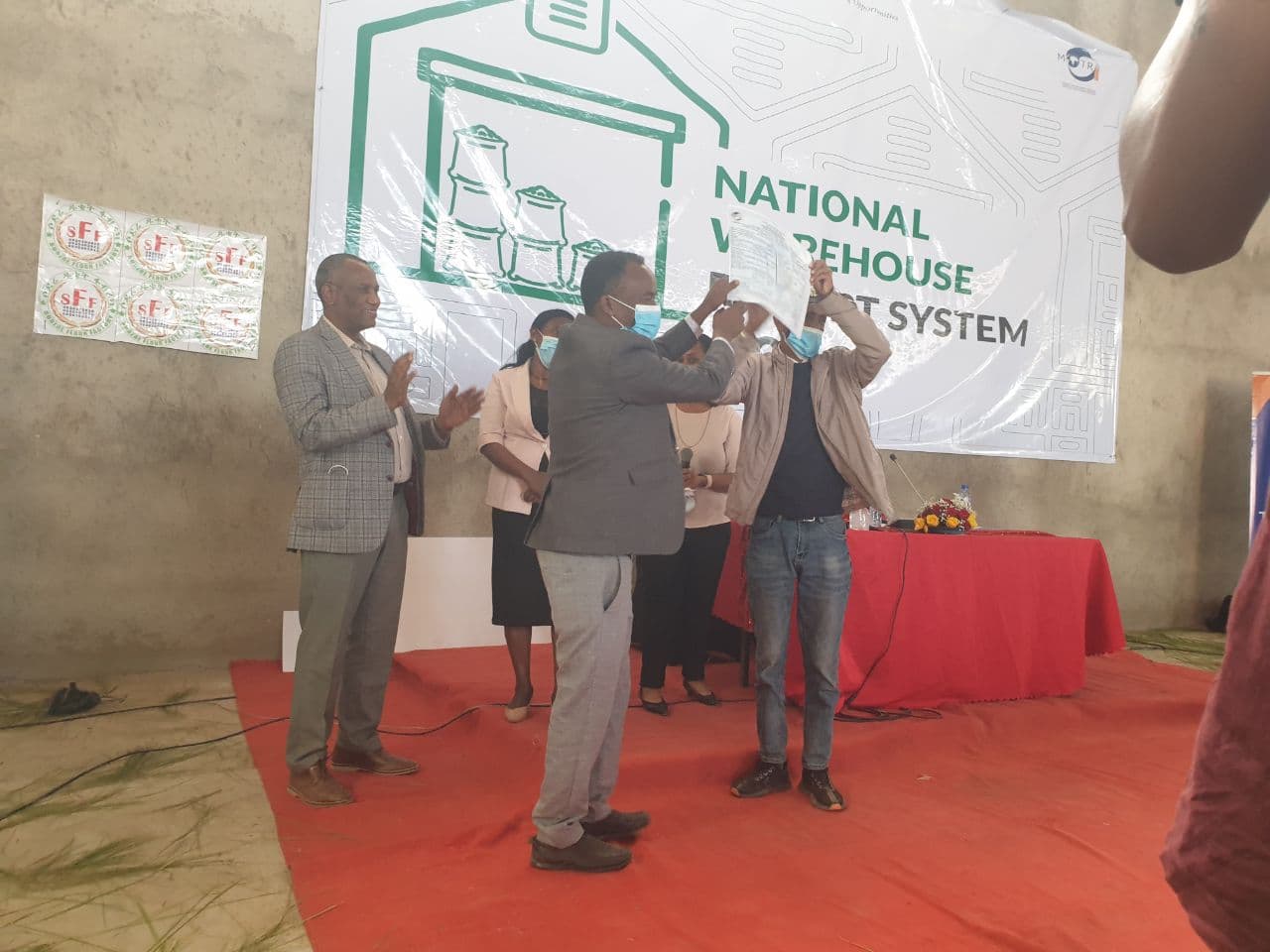

Cooperative Bank of Oromia has started Collateralized Commodity Financing (CCF) for the first time in Ethiopia.

Cooperative Bank of Oromia signed a memorandum of understanding with Jimma University

Fund-raising has been organized by the Coopbank Employees to support Artist Hachalu Hundessa’s family

The launch of Michu Uncollateralized Digital Lending Product in Pictures

17th Shareholders' General Assembly

Board of Directors

Board of Directors

Meskerem Debebe

Chair Person

Master of Business Administration (MBA), BA in Accounting

Abinet Tarekegn

Deputy Chair Person

MSc in Development Economics, MA in Cooperative Management, BSc in Rural Development and Agricultural Extension

Dr. Fikru Deksisa

Member

PhD in Agriculture, MSc in Forestry

Deribie Asfaw

Member

MBA in International Business, BA in Economics

Meseret Assefa

Member

MA in Project Management , BA in Management

Jemal Kedir

Member

MSc in International Trade and Economics, MA in Leadership and Change Management

Tegistu Shiferaw

Member

BA in Business Administration and Information Systems

Dr. Yeshi Jima

Member

PhD in Development Studies, MA in Development Studies

Aseffa Sumoro

Member

MSc in Finance and Development, MA in Development Economics .

Dejene Dadi

Member

Master of Business Administration(MBA), MSc in International Trade and Economics

Board Committees

Audit committee

Risk Management and Compliance Committee

Nomination and Remuneration Committee

Credit Committee

- Mr. Aseffa Sumoro : Chair Person

Executive Management

Executive Management

Deribie Asfaw

Cheif Executive Officer (CEO)

Aman Semir

Chief Transformation and Strategy Officer (CTSO)

Muluneh Aboye

Chief Financial Officer (CFO)

Abdi Fekede

A/Chief Operating Officer (COO)

Tadele Tilahun

Chief People Officer (CPO)

Shimelis Legesse

Chief Information Officer (CIO)

Desalegn Tadesse

Chief Risk, Compliance and Legal Officer

Tafesse Fana

Chief Internal Auditor

Senior Level Management

Yohannes Ambisa

VP, Agri and Cooperative Business

Nebil Abdella

VP, Interest Free Banking

Lense Geleta

VP, Growth and Operations

Wondyifraw Assefa Gadena

VP, Credit Appraisal and Portfolio

Kidus Mulugeta

VP, Technology and Strategy

Anteneh Tadesse

Senior Director of Core Banking, Infrastructure and Data

Sisay Fikadu

Senior Director of Strategy and Transformation

Geleta Abate

Senior Director of Technology and Innovation

Abayneh Meseret

Senior Director of Products

Fekadu Deresse

Senior Director, Central Finfinne District

Fikreyohans Lemma

Senior Director, Building Construction Management and Administration

Coopbank at a Glance

Coopbank at a Glance

History

In the early 2000s, Ethiopia’s rural communities faced a stark reality: financial exclusion that left farmers and small businesses without the resources to thrive. Amid this challenge, a visionary named Haile Gebre Lube emerged, determined to transform lives and unlock the potential of Ethiopia’s underserved populations. Guided by the belief that “the best way to fight poverty is through cooperation,” Haile embarked on a mission to create a financial institution rooted in community and collaboration.

Haile Gebre Lube established a project office In 2002 with a bold ambition: to build a bank that prioritized access to capital for the most vulnerable. By March 2005, this vision became a reality as Coopbank opened its doors, driven by a mission to empower individuals, foster partnerships, and enable sustainable growth.

Coopbank’s journey has been marked by ground breaking achievements in financial inclusion. On top of the billions of birrs the bank financed to various economic sectors over the years, Coopbank has revolutionized access to credit in Ethiopia by lending more than 44.5 billion birr to micro, small, and medium enterprises (MSMEs) using its innovative uncollateralized digital lending platform Michu. This transformative effort has reached over 2.6 million individuals, the majority being youth and women, through innovative digital lending solutions that eliminate the need for collateral.

Moreover, the bank’s cutting-edge technologies, such as FarmPass, have revolutionized the agricultural sector. These innovations enable farmers to access markets, secure loans, and benefit from tailored agri-finance solutions, creating sustainable opportunities for growth.

Coopbank is more than a financial institution; it’s a movement. Together, we can unlock potential, drive progress, and create opportunities for generations to come.

Welcome to Coopbank—where cooperation transforms lives.

Mission:

Rooting our foundation in communities, we redefine the banking experience, through innovative financial products to bank smarter and live better.

Vision:

leading the way in financial inclusion, sustainability, and community empowerment for a brighter future.

PURPOSE:

Empowering Communities, Transforming Lives.

Core Values:

S – Stewardship for Environment

C – Community Well-being

A – Accountability, Fairness, and Equity in Service Delivery

L – Living into & Respect for Tradition, Education and Innovation

E – Equal Opportunity & Inclusive Governance

MOTTO:

Empowering Communities, Transforming Lives