Michu: Empowering Ethiopian MSMEs Through Digital Lending

Welcome to Michu, the digital lending platform that understands your business needs and supports your growth. Whether you’re a small vendor, an aspiring entrepreneur, or an established MSME, Michu is here to help you thrive. Say goodbye to collateral requirements and long approval processes with Michu, your financing is just a few taps away.

Get Started with the App

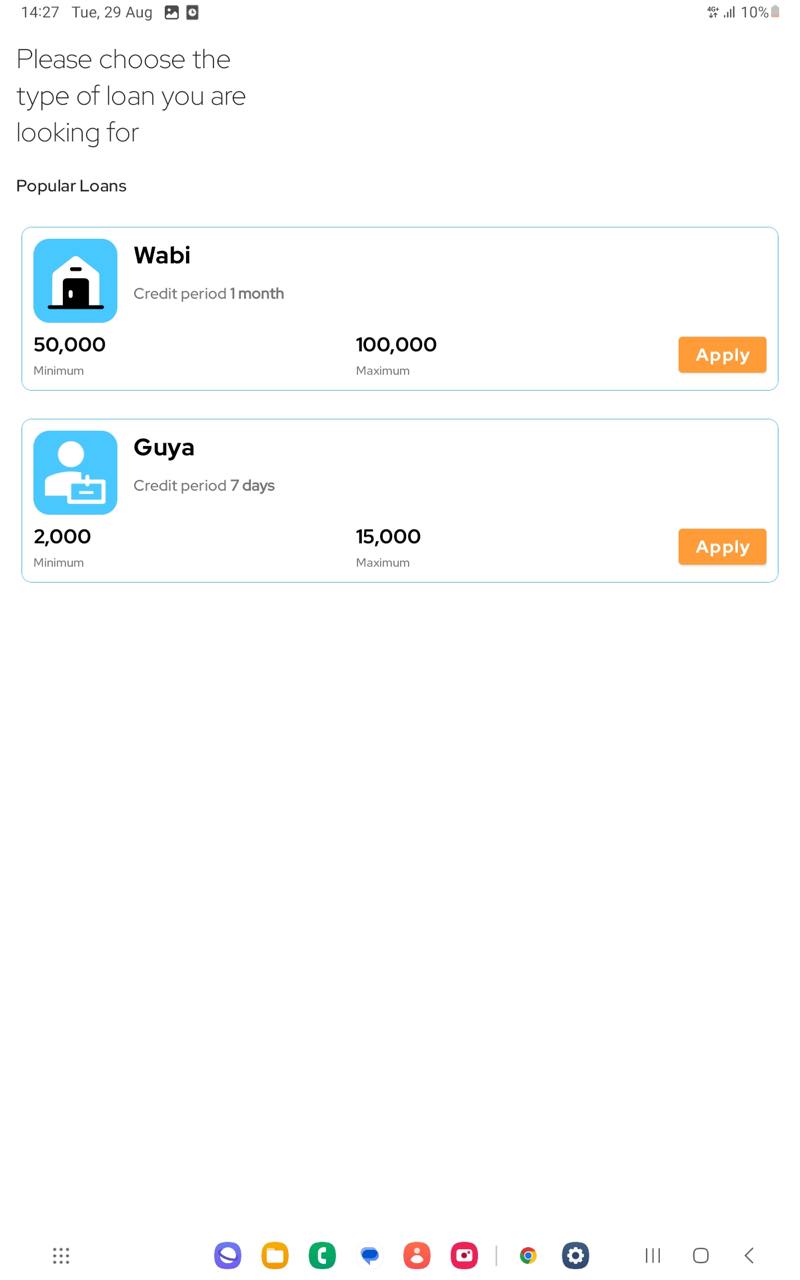

Loans Tailored for Your Business

With Michu, we believe in making financing accessible to all. That’s why we’ve designed three unique products to meet the diverse needs of Ethiopian businesses

This product is ideal for medium-sized enterprises looking for significant capital. With loan amounts ranging from 50,000 ETB to 100,000 ETB, Michu Wabi provides the financial boost you need to expand operations, purchase inventory, or upgrade equipment.

How Michu Works

Michu is entirely digital, making it easy and convenient for you to access the funds you need. Here’s how it works:

Sign Up

Create your profile, link your bank account, and provide some basic details about your business.

Get Your Loan

Apply for the amount you need and receive approval instantly. Funds are transferred directly to your account, ready for use.

Achieve More

As you repay your loans on time, Michu’s AI-powered system increases your eligible loan amount, helping your business grow with every step.

Transforming Lives, One at a time

With over 1.67 million MSMEs already supported, Michu is making a tangible impact across Ethiopia

Pricing

Privacy Policy

Michu operates strictly within all regulatory frameworks, ensuring a safe and secure lending experience for our customers.

Frequently Asked Questions

Michu Guya is designed for informal businesses, so a license is not required.

Approval is instant, and funds are deposited directly into your bank account

Repaying your loan on time increases your eligible loan amount for future applications, thanks to our AI-based system.

Your business deserves the chance to thrive, and Michu is here to make that happen. Download the Michu App today and take the first step toward your financial goals. It’s quick, it’s easy, and it’s designed with you in mind.