Coopbank SACCO-Link Core Banking Solution

Coopbank SACCO-Link Core Banking Solution is a key digital product that reflects Coopbank’s deep commitment to serving cooperatives and the wider community. As a financial institution rooted in society, Coopbank focuses on all segments, especially cooperatives that hold 61.25% of the bank’s shares. Striving to provide convenience, accessibility, and modern banking services, Coopbank continuously innovates through various digital banking solutions, achieving notable milestones.

The SACCO-Link Core Banking Solution is designed to deliver essential banking services tailored for cooperatives, SACCOs, and microfinance institutions. This product strengthens Coopbank’s leadership in Ethiopia’s digital banking sector by offering secure, efficient, and cutting-edge solutions that empower communities.

SACCO-Link Core Banking Features

SACCO-Link integrates seamlessly with Coopbank, ensuring that transactions—such as monthly payments from SACCOs or Union members—are reflected promptly and accurately. This Core Banking solution provides real-time data synchronization, detailed financial reporting, and secure transaction processing to enhance operational efficiency. Equipped with a range of powerful modules, it helps cooperatives and microfinance institutions manage their finances more effectively.

Members KYC Registration

Ability to upload KYC documents like Kebele ID, photo, and signature for quick creation and updating of KYC with full information.

Saving Accounts Management

Overseeing and handling operations related to savings accounts, including transactions, customer inquiries, and account maintenance.

Financial Reports

Documents presenting the financial performance and position of an entity, typically including balance sheets, income statements, and cash flow statements.

Loan Processing

The loan process captures documents, tracks guarantors with CA/SA deposits, and offers automated repayment options with a built-in calculator and loan schedule viewing.

Share Management

Share management involves overseeing share ownership, transfers, and compliance, ensuring transparency and shareholder satisfaction.

Inventory management

Inventory management involves overseeing the sourcing, storage, and tracking of goods to optimize operations and meet customer demand efficiently.

Members can enjoy the convenience of handling Savings, Share, and Loan accounts just like bank customers. Using all the digital services provided by Coopbank will enable members to access the services they need.

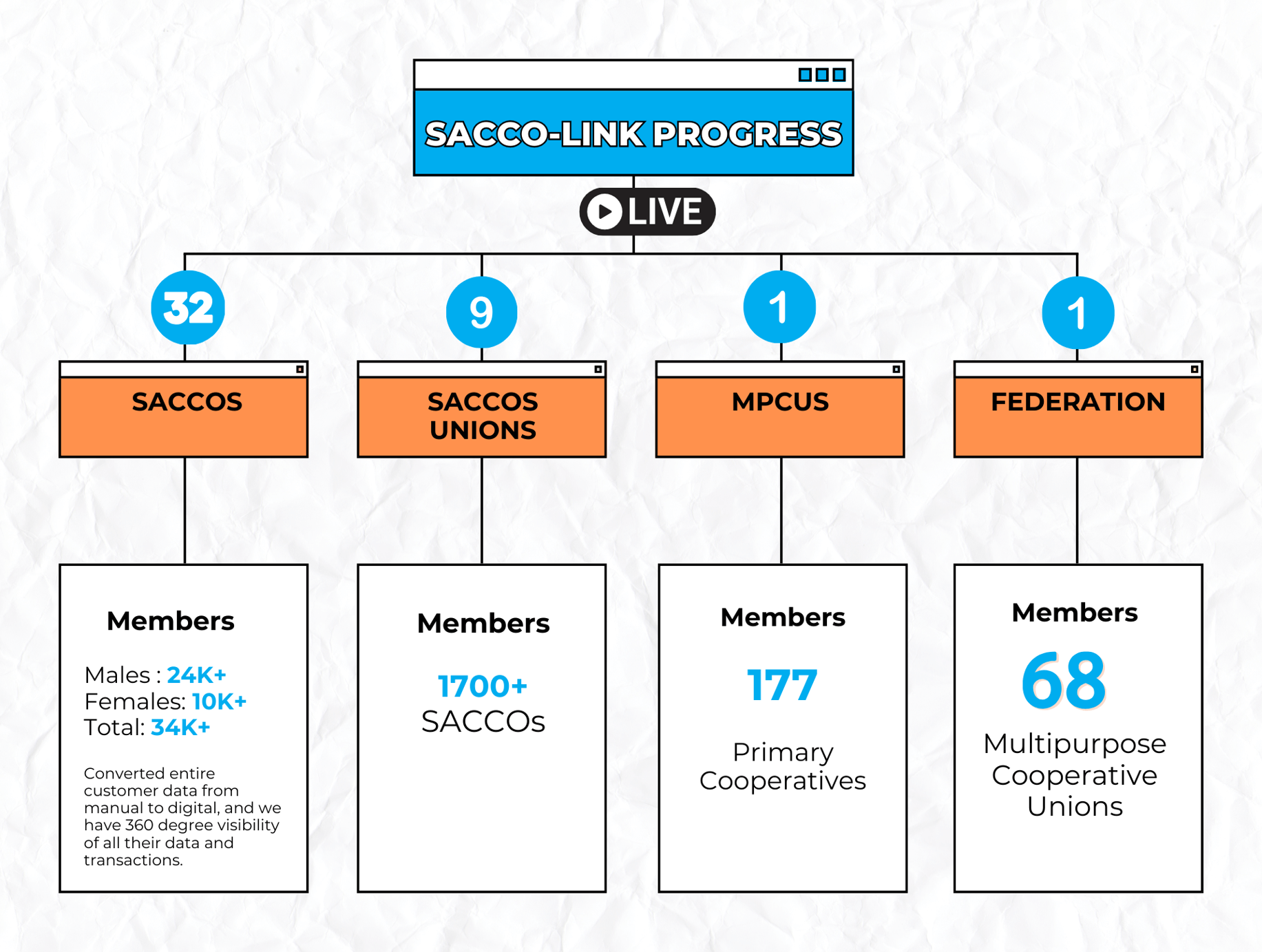

Product Progress

Why Choose SACCO-Link?

Process Automation:

Replace manual practices with efficient automation.

Wide Range of Services

Offer an extensive array of financial services.

Expanded Customer Base

Attract a wider range of customers.

Wider Integration

Change the color to match your brand or vision and more.

Coopbank SACCO-Link Security

•The SACCOs portal is fully secured, meeting the bank's standards.

•Bank's role is limited to setting up SACCOs and their admin framework.

•SACCO administrator adds users, assigning privileges.

•All processes undergo a formal maker-checker process.

•Users log in using their personal identification number and password.

•Plus additional security measures

Comprehensive Training and Support

Coopbank offers an extensive array of training options exclusively tailored for SACCOs or Unions regarding the core banking solution. The bank's expert team provides both virtual and in-person training sessions designed to equip SACCOs or Unions with mastery over the system. Continuous technical support ensures a seamless learning experience.

Business Requirements:

SACCOs, Unions, or MFIs are expected to meet the following criteria

- Open a Coopbank Saving Account if not already done.

- Prepare financial data according to Coopbank standard templates.

- Ensure the availability of data, internet, and a computer.

- Assign a dedicated person available for continuous training.

Testimonials of SACCOS

“Coopbank SACCO-Link core banking has truly revolutionized the way we conduct our financial business. The real-time data synchronization and secure transactions have enhanced our members' satisfaction, providing a cutting-edge banking experience.”

— Gadisa Boru Sacco Ltd.

“The business integration with Coopbank has allowed our members to enjoy the convenience of handling various account types and accessing additional services, contributing to the overall efficiency of our operations.”

— Waltane Ambo sacco union Ltd.

“SACCO-Link Core Banking Solutions transformed our financial operations, ensuring efficiency and eliminating manual transactions for improved workflow’’

— Tederash Saving and Credit Cooperative Society Ltd.

Join Coopbank SACCO-Link Core Banking Solutions

Coopbank invites financial cooperatives, unions, and microfinance institutions to join the expanding community that has embraced innovation with SACCO-Link. Experience the distinctive value of the bank’s advanced core banking solution, transforming operations, enhancing member satisfaction, and gaining a competitive edge in the dynamic financial market. Connect with Coopbank’s nearby branches today to embark on a journey towards efficiency, security, and growth with SACCO-Link Core Banking Solutions.

For further assistance, reach out to us at:

- +25111615822

- Let's collaboratively pave the way for a new era in financial services.

- +251965283802 or

- +251965283802

609