Banking Solutions

Regular Saving Account

Saving Deposit

Regular Saving Account

It is an interest-bearing account generally opened with a minimum of Birr 50. However, it can also be opened with a zero balance with the intention to establish a relationship and introduce banking services to potential unbanked customers. The account holder should credit at least a minimum of Birr 25 to her/his account within a month.

The following are the basic features and advantages of the account.

Additional Features:

- One can withdraw from her/his account by filing a withdrawal slip,

- It can be operated by a passbook and/or an ATM-Card,

- It can be opened and/or operated by a legal agent in the name of the principal, against a power of attorney,

- No restrictions on the number and amount of deposits and withdrawals unless restricted by pertinent bodies,

- It can be linked to Coopay-Ebirr to manage the accounts via mobile and Internet banking.

Benefits

-

- It improves the saving culture of society,

- It enables earning income through interest,

- It helps the depositor to make fund transfers,

- It enables payment through ATM/POS cards, internet, mobile, etc.,

- It provides immediate cash as and when required.

Account opening form

Youth Savings Account

Youth Savings Account

Youth savings account is an account designed exclusively for the youth of today, to make their tomorrow better by properly managing their attitude, lifestyle, preferences and behavior. It is an account for male and female youth segment in the age group of 15-29 years.

Features

- It is an account for male and female youth in the age group 15-29 years.

- Earns better interest rate than the normal saving rate.

- Zero minimum deposit requirements.

- It is accompanied by debit card.

- It has no transaction fee.

Benefits

- It improves the saving habits of self-employed teen-youth,

- It gives financial independence for the youth,

- It builds up future planning,

- It bears higher interest rate compared to ordinary saving account.

FCY Retention Account

FCY Retention Account

Forex Retention Account shall mean FCY account maintained by eligible exporters of goods and services and recipients of inward remittances from abroad. It can be opened to exporters and frequent SWIFT remittance receivers.

Types Of Retention Accounts

Eligible customers may open two types of foreign exchange retention accounts (current accounts), which shall be designated as “Foreign Exchange Retention A” and “Foreign Exchange Retention B.”

Retention Rights:

Exporters of goods and services, as well as recipients of inward remittances, shall have the right to retain their FCY earnings in retention accounts as follows:

Account “A”

It can retain 30% of his/her account balance for an indefinite period.

Account “B”

It can retain 70% of his/her account balance for up to 28 days after which period any balance shall automatically be converted in the next working day into local currency by the bank using the prevailing buying rate.

Deposit Products

Demand Deposit

Ordinary Demand Deposit Account

Ordinary Demand Deposit account is a non-interest-bearing checking account opened by a customer not in a delinquent list. The minimum amount required to open this account for individuals or individual traders is Birr 500 and for organizations/companies it is Birr 1,000.00.

Additional Features

- It can be opened and/or operated by a legal agent in the name of the principal, against a power of attorney.

- Bank statements can be issued on the account on a monthly basis.

Benefits

- It easily facilitates business transactions.

- It enables direct payments to beneficiaries’ accounts by issuing checks.

- No restrictions on the number and amount of deposit and withdrawal unless restricted by pertinent bodies.

Special Demand Deposit

Special demand deposit is a checking account in which interest is calculated at a rate less than the minimum interest rate of saving account set by the NBE.

Additional Features

- The account opening customer should not be in a delinquent list.

- It can be opened and/or operated by a legal agent in the name of principal, against a power of attorney.

- Bank statements can be issued on the account on a monthly basis.

Benefits

- It is very liquid and interest bearing;

- It facilitates effective business transactions.

- No restrictions on the number and amount of deposit and withdrawal unless restricted by pertinent bodies.

- It enables direct payments to beneficiaries’ accounts by issuing checks.

Digital Offerings

Digital Offerings

Empowering You with Smart, Fast, and Secure Digital Banking Solutions!

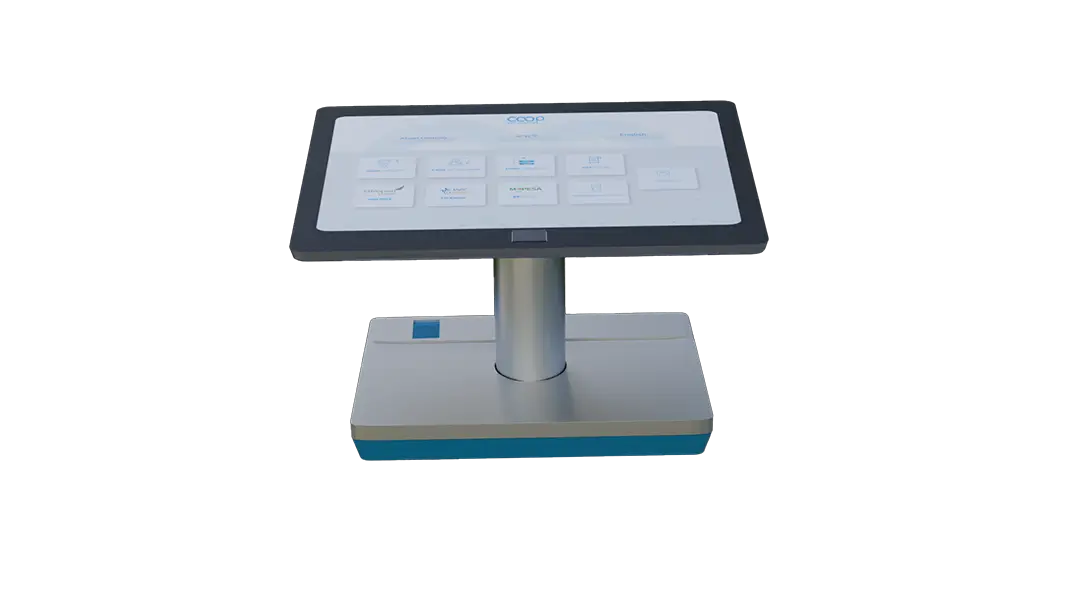

SMART Branches

Banking Made Simple, Fast, and Paperless Digital Convenience at Your Fingertips

Saving Account

Saving Deposit

Regular Saving Account

It is an interest-bearing account generally opened with a minimum Birr 50. However, it can also be opened with a zero balance with the intention to establish a relationship and introduce banking services to potential unbanked customers. The account holder should credit at least a minimum of Birr 25 to her/his account within a month.

The following are the basic features and advantages of the account.

Additional Features:

- One can withdraw from her/his account by filing a withdrawal slip,

- Can be operated by a passbook and/or an ATM-Card,

- It can be opened and/or operated by a legal agent in the name of the principal, against a power of attorney,

- No restrictions on the number and amount of deposit and withdrawal unless restricted by pertinent bodies.

- It can be linked to Coopay-Ebirr to manage the accounts via mobile and internet banking

Benefits

- It improves saving culture of the society,

- It enables earn income through interest,

- It helps the depositor to make fund transfers,

- Enables payment through ATM/POS cards, internet, mobile, etc.,

- It provides immediate cash as and when required.

Account opening form