Banking Solutions

Ijaraha Financing

Ijaraha Financing: -

is a form of financing applicable to financing and operating leases of properties.

Features

- In Ijaraha Financing the bank pays to manufacturer/builder the price of products and the manufacturer delivers the goods to the bank.

- In Financing Lease contract of Ijarah, the bank sells the products at the end of the contract, While

- In the Operating lease contract of Ijarah, the goods leased for customers and returned back to the bank to be released or disposed of.

- Please contact Coop bank Islamic to get more detailed information and advice.

Special Demand Deposit

Special Demand Deposit

Special demand deposit is a checking account in which interest is calculated at a rate less than the minimum interest rate of saving account set by the NBE.

Additional Features

- The account opening customer should not be in the delinquent list.

- No restrictions on the number and amount of deposits & withdrawals.

- It can be opened and/or operated by a legal agent in the name of principal, against producing a power of attorney.

- Bank statement issued on monthly basis.

Benefits

- It is very liquid and interest bearing

- It facilitates/enables to carry out effective business transactions.

- Holders of this account can withdraw from their own account without any restrictions.

- It enables you to make a direct payment to your creditors by issuing checks.

- Enables you to make multi-locational fund transfers.

Fixed Time Deposit

Fixed Time Deposit

Fixed time deposit is a type of deposit which is accepted for a certain fixed period of time with negotiable interest rate. The rates of interest vary according to the duration of the deposit received and calculated only for the duration of the certificate of deposit.

Additional Features:

- The minimum balance acceptable for fixed a time deposit is Birr 500,000 (Five Hundred Thousand).

- Certificate of deposit (CD) shall be issued to the depositor.

- Withdrawal is not generally allowed before the maturity date. However, with convincing proposals, customers can enjoy their accrued interest even if they withdraw before the maturity date.

- Can be renewed for a further period.

- No interest will accrue after expiry.

Benefits of fixed time deposit

- It encourages saving habits for a longer period of time.

- Earns higher interest rate.

- On maturity the amount can be used for planned expenditure.

ECX Related Accounts

ECX Related Accounts

ECX related account is a special type of account opened in an electronically networked branch as Pay-in/Pay-Out account for the members of the Ethiopian Commodity Exchange to facilitate the trading of Commodity at ECX trading centers. The limited member pay-out and limited client pay-out can be operated from either an electronically networked branch or non-networked branch.

Account opening request shall be lodged by the ECX through an account

opening facilitation letter to the bank by clearly specifying; ECX Member type, ECX Bank account required, and a networked branch selected by the member for the account.

Additional Features

- The account is opened for a member who is not prohibited by the National Bank of Ethiopia from owning and operating bank accounts;

- The Member shall present power of attorney, giving the sole right of debiting the Pay-in account to the Exchange, prepared in four copies and shall be signed by the Principal authorized officials at the counter of the account opening branch, in front of two witnesses.

- The member also presents ECX Member certificate (ECX member ID).

Benefits

- It helps the members of the ECX to facilitate the trading of Commodity at ECX.

Ordinary Demand Deposit Account

Demand Deposit

Ordinary Demand Deposit Account

An ordinary Demand Deposit Account is a non-interest-bearing checking account opened by a customer, not in a delinquent list. The minimum amount required to open this account for individuals or individual traders is Birr 500 and for organizations/companies, it is Birr 1,000.00.

Additional Features

- It can be opened and/or operated by a legal agent in the name of the principal, against a power of attorney,

- Bank statements can be issued on the account on a monthly basis.

Benefits

- It easily facilitates business transactions,

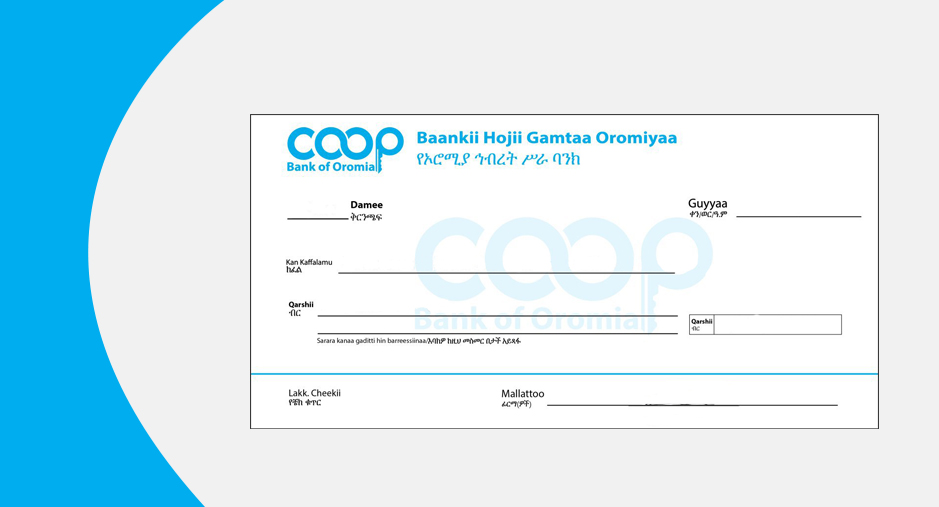

- It enables direct payments to beneficiaries’ accounts by issuing checks,

- No restrictions on the number and amount of deposits and withdrawals unless restricted by pertinent bodies.

Special Demand Deposit

A Special Demand Deposit is a checking account in which interest is calculated at a rate less than the minimum interest rate of a savings account set by the NBE.

Additional Features

- The account opening customer should not be in a delinquent list,

- It can be opened and/or operated by a legal agent in the name of the principal, against a power of attorney,

- Bank statements can be issued on the account on a monthly basis.

Benefits

- It is very liquid and interest-bearing,

- It facilitates effective business transactions,

- No restrictions on the number and amount of deposits and withdrawals unless restricted by pertinent bodies,

- It enables direct payments to beneficiaries’ accounts by issuing checks.

Demand Deposit Account

Demand Deposit Account (Current or Checking Account)

Demand Deposit account (current or checking) is a non-interest-bearing account that offers the greatest liquidity. It can be opened and operated by individual and businesses as well as a legal agent in the name of the principal, against producing a power of attorney.

This product consists of Ordinary Demand Deposit Account, Interest-Bearing Demand Deposit Account, and ECX related accounts.

Gudunfa Savings Accounts

Gudunfa Savings Accounts

Gudunfa is a type of deposit where customers request for a special “Saving Box” in which they deposit money on a piecemeal basis at their business premises. The Gudunfa (Saving Box) is brought to the bank’s branch that served it at a certain time interval to be deposited to the customer’s account.

The following are criteria to open and use Gudunfa Saving Box.

Features

- A minimum of Birr 350 initial amount has to be deposited to the savings deposit account, which is equivalent to the cost of the box.

- The initial deposit amount deposited shall be debit restricted as long as the customer continues to use the box.

- Gudunfaa keys should be kept at the branch providing the service.

- Gudunfaa shall be opened by the branch manager or her/his delegate in the presence of the customer and the money in the box should be counted and deposited to their saving account.

- Customers can withdraw any amount from their saving account, but the initial deposit amount should not be altered.

- Request for Gudunfaa shall only be lodged at the branch where the customer’s account is maintained.

Benefits

- It enables customers to deposit their money right at their business premises and minimizes frequency of visiting branches.

- It can serve as a saving vault in a situation where the customers cannot come to branches.

- It encourages customers to gradually accumulate their meager daily income into the box.

Gamme-Junior Account

Gamme-Junior Account

Gamme-Junior Account of Coopbank is a savings account designed for children aged 0-14 years.

It is opened in the child’s name, but usually operated by parents and/or guardians until the child is old enough to manage the account by herself/himself. It can also be opened and operated by the children themselves independent of parents/guardians if it is proved that they have an income of their own.

Transactions are supervised/managed by parents/guardians/tutor, and withdrawal requests are handled as agreed by parents. If the parent/guardian who had opened the account becomes incapable of exercising or loses her/his power of guardianship for various reasons, another guardian appointed by the law shall operate the account by producing a legal document, which ascertains her/his guardianship authority.

Birr 100 will be credited to their account by the bank as an incentive when their average six months deposit level reaches Birr 30,000.00 (Thirty Thousand Birr) and above. Birth certificate or any evidentiary document issued by a pertinent government organ shall be presented during account opening.

Additional Features

- No minimum deposit amount required to open this account.

- No debit card is issued on this account.

- Better interest rates than the regular saving rate.

- Children that have proved to have income of their own and who opened the account by themselves can have access to their deposit account any time they need.

Benefits

- It provides seed money for children in their later age,

- Higher interest rates and other benefits attached to this product.

- Enables parents to teach saving culture to their children at early age.

- Encourages building up for future planning.

Special Saving Account

Special Saving Account

Special savings account is an interest-bearing account which is opened by individual customers and can be operated with cheques. It has similarity with other category of active saving accounts with the exception that individuals use cheques to operate this account.

Additional Features

- Opened or operated by literate customers only.

- Not opened for organizations and companies.

- The customer should not be in a delinquent list.

Benefits

- It is an account opened for prominent customers of the bank.

- No passbook is required for such accounts.

Saving Account

A. Gamme-Junior Account

Junior Gaammee is the second Gadaa grade in which children with the age group between 9 -16 are classified. They are mainly student in characteristic. Gamme-junior account in CoopBank is a saving account designed for children aged from 0-15 years.

It is opened in the child’s name. But, usually operated by the parent and/or guardians until the child is old enough to operate the account by him/herself. It can also be opened and operated by the children themselves independent of parents/guardians if it is proved that they have income of their own.

It can be opened and operated by the parents jointly, by the parent or guardian, or solely by themselves. Transactions are supervised/managed by parents/guardian/tutor and withdrawal requests are handled as agreed by parents. If the parent/guardian who had opened the account becomes incapable to exercise or loses his/her power of guardianship for various reasons, another guardian appointed by the law shall operate the account by producing a legal document, which ascertains his/her sole guardianship authority.

Birr 100 will be credited to their account by the bank as an incentive when their average six months deposit level reaches Birr 30,000.00(Thirty Thousand Birr) and above. Birth certificate or any evidentiary document issued by pertinent local or federal government organs shall be presented during account opening.

Additional Features

- No minimum deposit to open this account.

- No transaction fee and account maintenance are free.

- No debit card is issued on this account.

- Better interest rate than the normal saving rate will be applied on the account.

- The Account should be opened in such a way that the Bank would be able to make payment:

- To the junior when he/she attains the age of youth (as internally defined by bank’s procedure) by ascertaining it via pertinent documents to this effect.

- To his/her guardian appointed by the court of law when his/her parents die while he/she is a minor.

- Children that have proved to have income of their own and who opened the account by themselves can have access to their deposit account any time they need.

Benefits

- It provides seed money for children in their later age,

- No transaction and account maintenance fees.

- There is higher interest rate and other benefits attached to this product.

- Teach saving culture to the children

- Build up future planning.