Banking Solutions

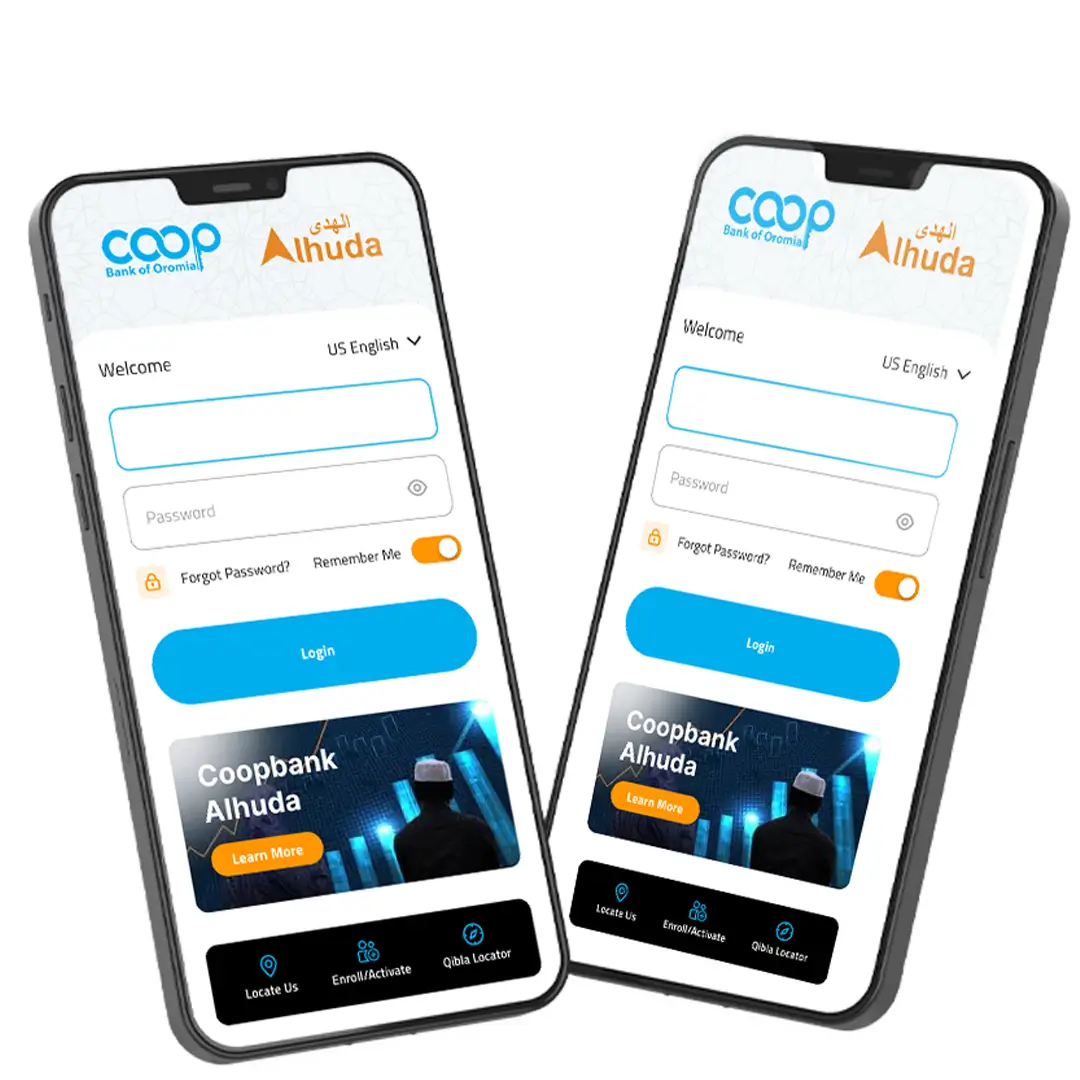

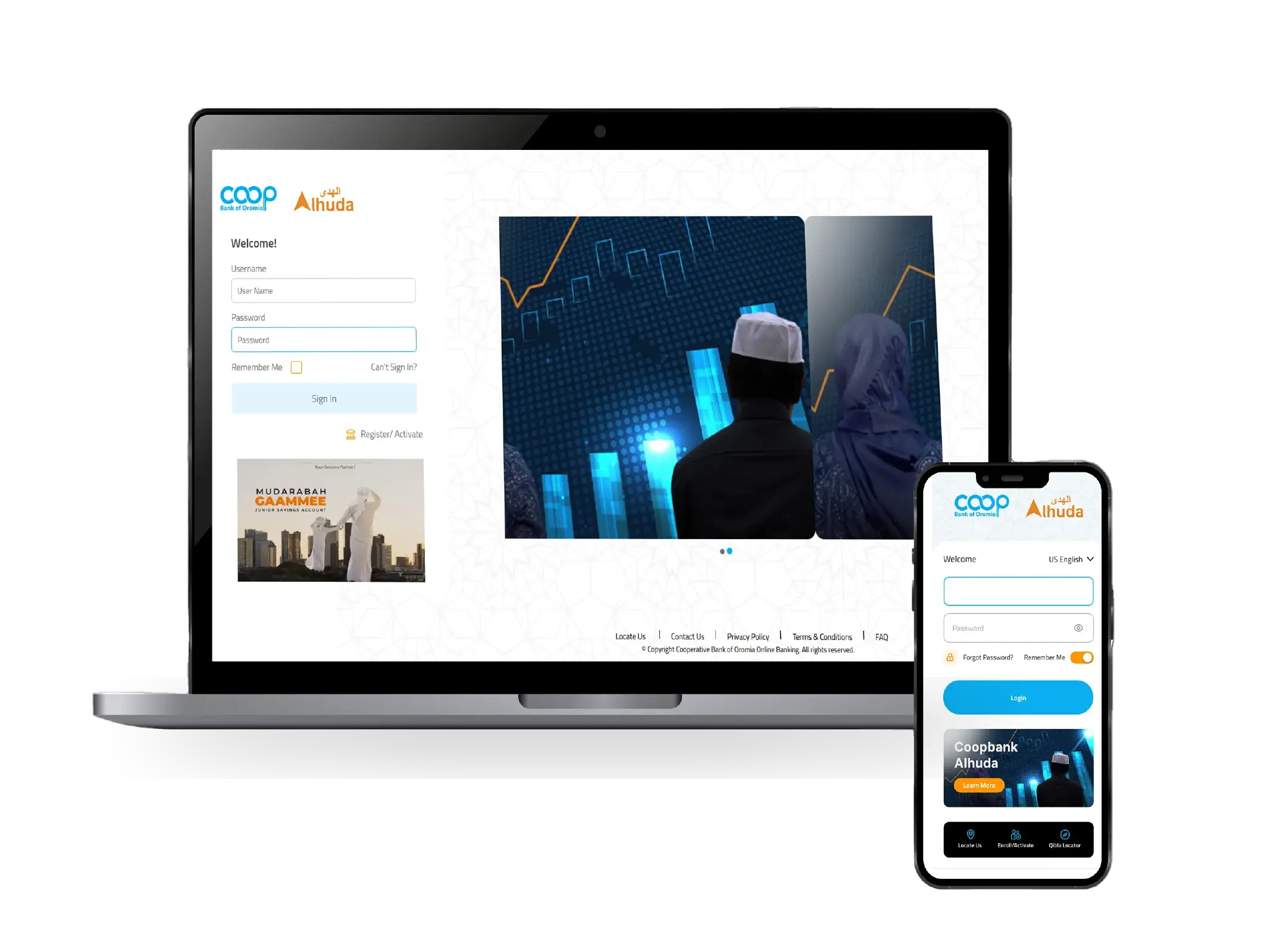

CoopApp Alhuda

Coop App Alhuda

Coop App Alhuda Omni-Channel platform, represents a leap forward in technology, seamlessly integrating across web portals and mobile applications. With tailored solutions designed for businesses and individual retail customers, this innovation ensures enhanced accessibility, convenience, and security in managing Conventional banking financial solutions.

Why Use Coop App Alhuda

Experience banking convenience with the flexibility of both conventional banking and interest-free banking services, all conveniently located in one place. Applications and web provide a seamless and consistent user experience across various channels and devices.

Efficiency

No more waiting in line or dealing with payment hassles

Diversification

Access a wide range of financial products and services.

Uniformity

Enjoy a consistent operational experience across all channels.

Easily view

Customizable

Choose authentication methods such as biometrics or PIN for secure access.

Security

Temporarily block account access in case of lost or stolen devices or suspicious activity.

Accessibility

Locate nearby branches and ATMs for quick and convenient access to services.

Insight

Access real-time account monitoring and transaction history and much more.

Retail Banking

Leveraging the latest technologies to create personalized, seamless experiences for customers across various digital touchpoints, it offers services such as online and mobile apps, catering to the convenience of customers, providing access to information, and transactional services anytime, anywhere.

• Various banking services for personal transactions.

• Monitor and manage finances with ease and convenience.

• Enjoy secure and convenient online bill payment functionality.

• Easily view and edit personal information and account settings.

• Empowers to manage finance via mobile apps and online banking interactions.

• Allows to enjoy a seamless experience.

• Enables to manage accounts, make transactions and acces banking services 24/7.

Coop App Alhuda Business Banking

With Coop App-Alhuda, businesses can manage finances easily and efficiently across channels

Business banking enables business customers to interact with their finances seamlessly across multiple channels. It helps businesses simplify their financial management processes and ultimately achieve operational excellence.

•Provides access to a wide range of financial products and services across all channels.

•Enables utilization of online banking services to manage financial activities.

•Enables easy management of financial activities, streamlines workflows, and reduces operational costs.

•Enable easily create and manage signatories to your accounts, enhancing convenience and efficiency.

•Utilize approval matrices to maintain control over transactions and account access.

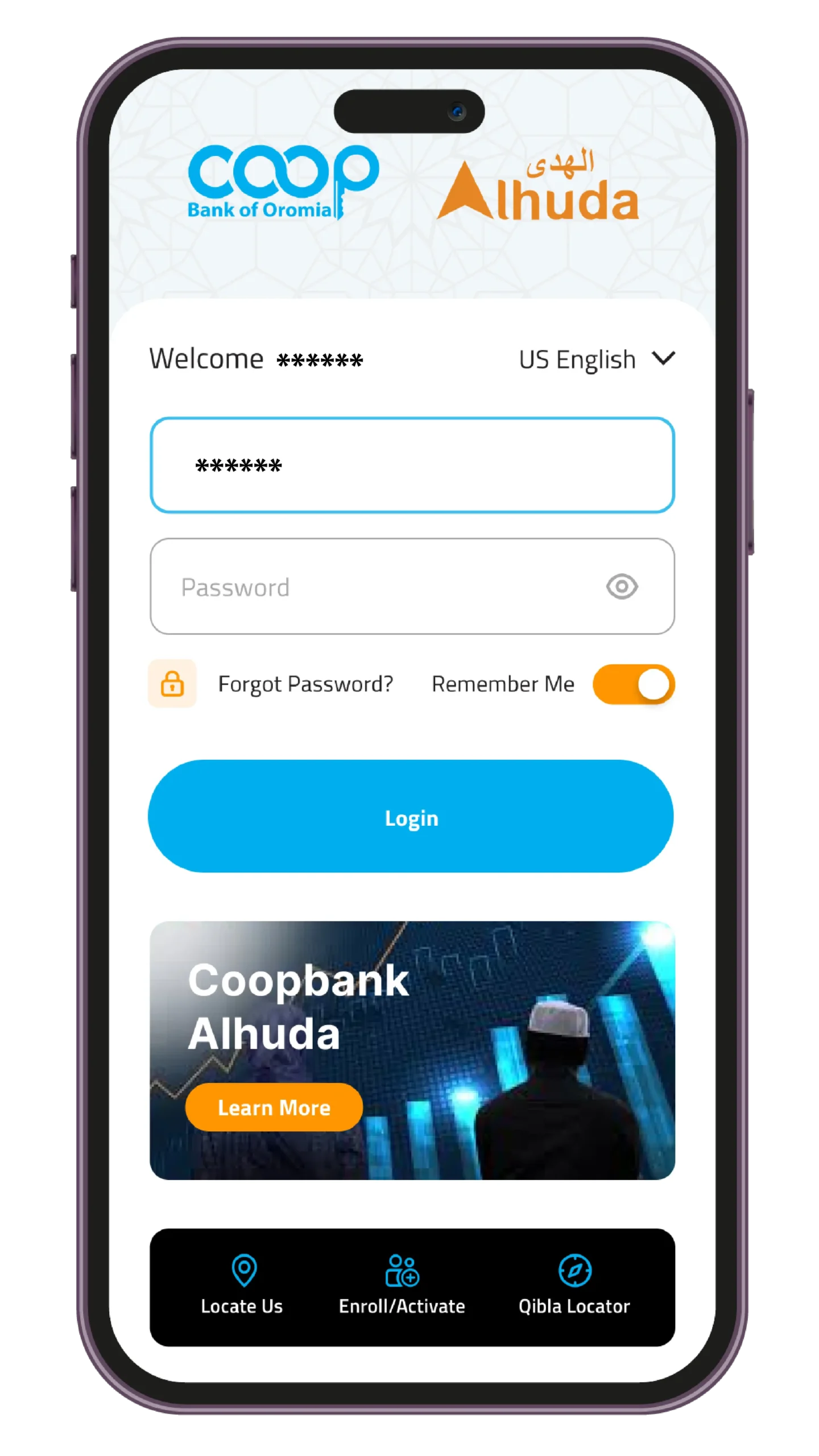

Getting started is simple

The following steps will guide you through the application process for CoopApp Alhuda.

Download the app

Download the most recent version of CoopApp from the Google Play Store or the App Store.

Choose Retail Banking.

Enter your account number and Captcha

Enter your account number along with the provided Captcha code for secure access to your account.

Enter the activation ID & code

Enter the activation ID and code sent to your phone via SMS to complete the activation process. Verify your identity and unlock access to your account.

Enter a password

Enter a password with a minimum of 8 alphanumeric characters for secure access. Ensure your account's safety by creating a strong and unique password.

Register for CoopApp Alhuda

Register for CoopApp account.

Click on Register Now.

to create your account and gain access to our services.

Select Activate Now.

to initiate the activation process quickly. Begin enjoying the benefits of your account in just a few simple clicks.

Choose a username

Choose a username with at least 8 characters and we'll check its availability for you.

You're done!

You're done! start your transaction and enjoy your day.

Farmers’ Savings Account

Farmers’ Savings Account

Farmers’ Savings Account is a savings account uniquely designed for farmers – engaged in agriculture, pastoralists and fishing with attractive interest rates. The product is designed to specifically encourage the unbanked and underbanked farmers to save and transform their living via banking practices.

With a literacy rate of only 51.7%, the country’s farming communities are prone to; frequent drought, lack of training and equipment, poor access to markets, and a low level of saving habits. The extravagant nature of spending during harvest seasons is mainly the driving factor of the low saving culture of the country.

Through enhanced banking practices farmers can improve their livelihood by developing their saving culture, access to finance and basic technical support, obtain advisory services, purchase of new agricultural techniques and inputs, secure better seeds, fertilizer, and chemicals.

The product will have the following requirements and features;

- The initial deposit is ETB 25.

- All requirements for opening accounts shall be applicable, such as two passport-sized photographs, renewed ID cards including Farmers’ Association ID cards, land ownership certificates, Pension ID cards, or others.

- Better and attractive interest rates will be paid for this account higher than that of the regular savings account.

- Capacity building and financial literacy trainings will be given, especially for well-performing savers.

- Reward on a lottery method is arranged for beneficiaries of this account. Accordingly, various prizes related to and relevant to the agriculture sector will be offered by the bank.

Benefits of the Product for Farmers

- It will assist the farmers to cover their operational expenses, expansion of their operation, or taking advantage of new opportunities available to them.

- It also enables the farmers to build a better future and investment.

- It will improve the farmer’s access to banking services and modern agricultural inputs and techniques.

- Apart from saving contributions to farm inputs, it enables the farmers to send their children to schools.

Card-Banking

Card Banking

Your financial journey made simpler, faster, and secure with Cooperative Bank of Oromia. At Cooperative Bank of Oromia, we’re not just offering card banking services; we’re transforming how you manage your money. With our Prepaid-Cards, Debit-Cards, and Cash-Recycling Machines(CRMs),we combine cutting-edge digital solutions with24/7accessibility to help you bank smarter and live better.

Debit Cards

Experience fast, secure, and convenient banking with our Card Banking services, designed to give you control of your finances anytime, anywhere

COOP INFINITE CARD

A local debit card issued by the Cooperative Bank of Oromia, directly linked to the customer’s bank account. It enables unlimited ATM withdrawals and POS transactions. It is fast, convenient, and secure for all types of payments.

Features

Product Definition-Elite-tier with no transaction limits

Minimum Account Balance-Deposit >50,000,000

ATM Withdrawal Limit-No Limit

POS Payment Limit-No Limit

Eligible Accounts-For Executives, VIP clients, high-net-worth individuals

Card Expiry-5 years

Support-24/7 Support

Instant Issuance-Yes

COOP PLATINUM CARD

A local debit card designed for exclusive customers and business owners. It allows high-value ATM withdrawals and POS transactions. It ensures fast, secure, and convenient payment services.

Features

Product Definition- Premium for business owners

Minimum Account Balance- Deposit >20,000,000

ATM Withdrawal Limit -16,000 ETB/day

POS Payment Limit- 500,000 ETB/day

Eligible Accounts- Intended for professionals and business owners seeking exclusivity

Card Expiry-5 years

Support-24/7 Support

Instant Issuance-Yes

COOP GOLD CARD

A local debit card provided to customers who value premium services. It supports high-limit ATM withdrawals and POS transactions. It offers reliable, fast, and secure financial access.

Features

Product Definition- Affluent clients with premium access

Minimum Account Balance- Deposit >10,000,000

ATM Withdrawal Limit – 14,000 ETB/day

POS Payment Limit- 500,000 ETB/day

Eligible Accounts- For mid-to-upper income earners who want enhanced services and lifestyle perks.

Card Expiry-5 years

Support-24/7 Support

Instant Issuance-Yes

COOP SILVER CARD

A local debit card offered to mid-level customers with moderate banking needs. It enables increased ATM withdrawals and POS transactions. It is secure, convenient, and efficient for everyday use.

Features

Product Definition- Mid-level users with moderate needs

Minimum Account Balance- Deposit >500,000

ATM Withdrawal Limit – 12,000 ETB/day

POS Payment Limit- 500,000 ETB/day

Eligible Accounts- For individuals with moderate spending needs

Card Expiry-5 years

Support-24/7 Support

Instant Issuance-Yes

COOP CLASSIC CARD

A local debit card available to all account holders of the Cooperative Bank of Oromia. It serves essential banking needs with safe, fast, and convenient access to funds.

Features

Product Definition- Basic debit card for everyone

Minimum Account Balance- Deposit >100

ATM Withdrawal Limit – 12,000 ETB/day

POS Payment Limit- 500,000 ETB/day

Eligible Accounts- For entry-level clients

Card Expiry-5 years

Support-24/7 Support

Instant Issuance-Yes

Non-Resident Accounts

Types Of Non-Resident Accounts

- Non-Resident Foreign Currency Account

- Non-Resident Non-Transferable Birr account

- Non-Resident Transferable Birr Account

- These accounts are opened for those organizations and individuals who are permitted to open NR – FCY accounts,

- Opening criteria and procedure are the same as that of the NR – FCY account,

- The balances of these accounts are expressed in Birr,

- Transfers from these accounts are exempted from the exchange commission,

- As the name itself indicates the balance of these accounts can be converted or transferred abroad or to NR – FCY account without prior approval of NBE.

Eligibility

- Diplomatic mission offices,

- Diplomatic mission staff (except for Ethiopian nationals),

- Members of the International Community,

International organizations and their organs.

Agricultural Investment Loan

Agricultural Investment Loan

It is a short to long term loan granted to Cooperatives, Associations, Commercial Farms, or Individuals for working capital as well as purchase or lease of buildings, agro-processing machinery, and equipment (such as water pumps, generators, combine harvesters, tractors, vehicles, coffee processing machines, etc.), for plant and animal production (dairy production, poultry production, and livestock fattening activities) in small/medium/large-scale farming, construction of storage facilities, etc.

The bank gives priority to modern commercial agriculture ventures that produce for the export market and may finance both rainfed and irrigation system farming. The bank may provide a maximum grace period of five years for plantations like coffee plantation and a maximum of two years for other agricultural farms.

Agricultural Input Loan

Agricultural Input Loan

Fertilizer Loan

It is a short-term agricultural loan granted for the purchase of fertilizers. The applicant can be Cooperatives, Associations, Commercial Farms, Individuals, or Regional State. Applicants that are established as Cooperatives or Associations may be extended clean based fertilizer loan; however, they have to:

- Acquire legal personality from the concerned governmental organ.

- Present Minutes of a resolution passed by at least three-fourths of the members of the General Assembly of their Cooperative /Association.

- Provide audited financial statements.

- Employ a Manager and an Accountant/Bookkeeper; and

- Present letter of guarantee from the Regional Government which in turn shall present a letter of guarantee from the Ministry of Finance and Economic Development.

Other Agricultural Input Loans

It is a short-term loan granted to Cooperatives, Associations, Commercial Farms, Individuals, and Regional Governments engaged in the agricultural sector for the purchase of agricultural inputs other than fertilizers like improved seeds, and/or agrochemicals.

Import Letter of Credit Settlement Loan

Import Letter of Credit Settlement Loan

Import Letter of Credit Settlement Loan is a form of a loan extended to a borrower by converting the outstanding import letter of credit document’s value either to a merchandise loan facility or to a term loan upon the fulfillment of the required eligibility criteria for a maximum period of one year when a customer is unable to clear the L/C documents due to shortage of cash flow. The customer couldn’t be allowed not more two times a year.

In addition to the General Eligibility Criteria, the customer shall fulfill the following specific requirements.

- The customer’s credit risk shall be grades 1, 2, or 3.

- The bank shall finance only import letter of credits opened at its end.

- The applicant shall not have any other long outstanding import letter of credit document arrived.

- The customer shall apply for a loan within five days after the bank advised the arrival of a letter of credit documents.

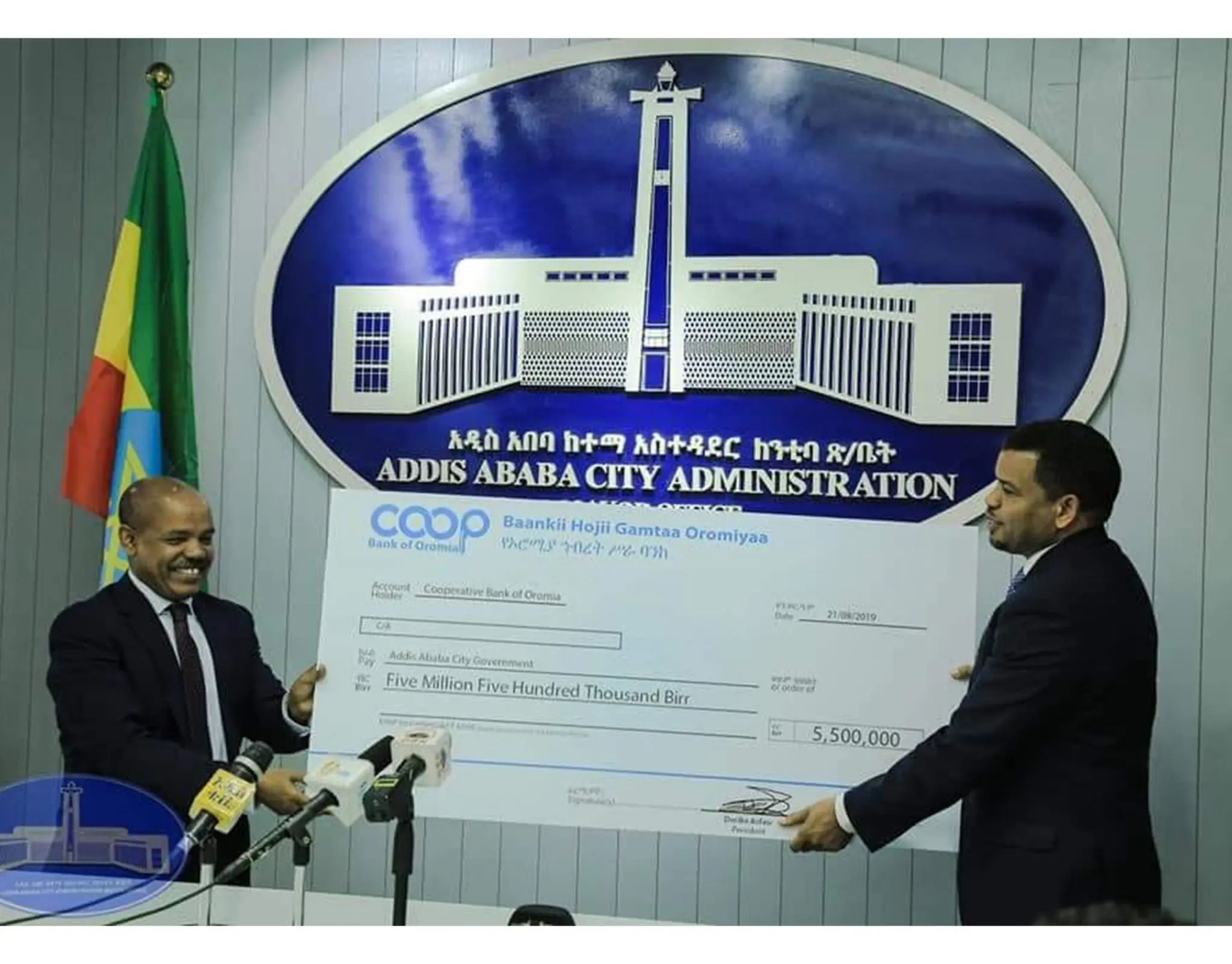

CSR

CSR at Coopbank: Growing Responsibly

At Coopbank, Environmental, Social, and Governance principles guide our mission to deliver inclusive, ethical, and sustainable banking services. We believe in creating long-term value that benefits not just our customers, but also the communities and environment around us.

Environmental Commitment

We support a greener future by investing in renewable energy, promoting eco-friendly operations, and organizing tree-planting and environmental conservation activities across the country.

Social Impact

Coopbank is dedicated to financial inclusion, with special focus on rural, low-income, and underserved communities. Our innovative services and outreach programs help expand access to financial tools, while we also support education, health, and community development through targeted social initiatives.

Governance

We operate with transparency, accountability, and strong ethical standards, guided by inclusive leadership. Our governance practices strengthen public trust and reinforce our role as a reliable and responsible financial institution.

Coopbank’s Charitable Contribution to Babul Keyer Charity Organization

As part of Coopbank’s 20th Anniversary celebration, the Bank’s Management, in collaboration with the Coopbank Alhuda (IFB) team, visited the Babul Keyer Charity Organization. This engagement, carried out under the ‘Project 20 for 20’ initiative, involved the provision of both cash and in-kind support. The initiative reflects Coopbank’s unwavering commitment to social responsibility and its solidarity with organizations dedicated to uplifting vulnerable communities. Through such meaningful engagements, Coopbank continues to promote empowerment and sustainable change.

Coopbank’s Support for Vulnerable Children at Yetim Children Care Center

In celebration of its 20th Anniversary, Coopbank’s Management, along with the Coopbank Alhuda (IFB) team, visited Yetim Children Care Center to extend both cash and in-kind assistance under the ‘Project 20 for 20’ initiative. This visit underscores the Bank’s long-standing dedication to improving the lives of vulnerable children. By providing critical support, Coopbank aims to empower future generations and contribute to their education, development, and overall well-being—building a brighter, more secure future for all.

Coopbank’s Ramadan Relief Initiative for IDPs Across Multiple Towns

Demonstrating compassion in action, Coopbank, in partnership with its Islamic Banking Department (Coopbank Alhuda), provided essential support to Internally Displaced Persons (IDPs) across Gelan, Koye Feche, Dukem, Lege Tafo, Sululta, Arsi-Aminya, Chiro, Sebeta, and Burayu sub-cities. Organized during the holy month of Ramadan, the initiative featured street Iftar programs offering vital food supplies and aid to those in need. This humanitarian outreach exemplifies Coopbank’s mission to uplift marginalized communities—promoting dignity, solidarity, and resilience in times of hardship.

As a responsible corporate citizen, the bank and its employees are involved in various social aspects via donations and sponsorships.

- Donation of ETB 70,000,000 (Seventy Million Birr) was made for drought victims, in different parts of the region

as a responsible corporate citizen, the bank and its employees are involved in various social aspects via donations and sponsorships.

- Donation of ETB 70,000,000 (Seventy Million Birr) was made for drought victims, in different parts of the region

As a responsible corporate citizen, the bank and its employees are involved in various social aspects via donations and sponsorships.

- Donation of ETB 23.7 million was made for communities displaced from border conflicts in the year 2017.

- In-kind support of 3,200 quintals of food items was made for the people affected by the El Nino caused drought, which particularly affected southern and south-eastern parts of the country.

- Since the outbreak of COVID-19, the bank has been undertaking various measures like donations amounting to ETB 8 million and temporarily gave its buildings to Oromia Regional State in Naqamte and Kuyu towns to be used for this purpose. The bank has also waived all fees from digital banking platforms, including ATMs and Coopay (Mobile Banking) fees, LC extension fees, and made a loan interest rate reduction of up to 5%.

The bank is dedicated to creating economic value for all stakeholders, including our customers, regulatory organs, and the larger society. Specifically,

- We remain committed to driving sustainable growth in agriculture, manufacturing, trade and commerce, construction, real estate, foreign trade (import and export), among other sectors of the economy

- We will continue to support the sustainable development of society through our wide-presence in rural areas.

- We will continue playing a very constructive and meaningful role in promoting the financial inclusion of the country.

The bank is well-known in supporting various cultural orientations through sponsorships to promote culture, art and related concerns.

We have been supporting and remain committed to financial supports made for new movies, music awards, cultural festivals, and various cultural festivities.

We will continue to support such incentives for they contribute to create sustainable values for the communities

In the light of environmental protection, we believe that environmental sustainability is critical globally for the communities we serve and for our citizens. Therefore;

- We are committed to preserving biodiversity and natural resources and collaborate with those working/concerned with environmental protection

- We do business with companies that support ecological issues and ensuring their products and services in promoting environmental protection

- We also encourage and funding for NGOs and charity Organizations working on environmental protection.

- We are participating in the nation-wide tree planting campaign every year.

Coopbank Champions the Green Legacy Initiative in Adama

Following the Management Workshop in Adama, over 1,000 Coopbank management members participated in the Green Legacy Campaign, planting trees as part of the Bank’s strong commitment to environmental sustainability.

This initiative, which Coopbank also regularly carries out in Addis Ababa, reflects our ongoing dedication to creating a greener, healthier, and more sustainable future for all.

Recently, since the outbreak of COVID-19, the bank has been undertaking various measures like a donation amount of ETB 8 million and temporarily gave its buildings to Oromia Regional State in Nekemte and Kuyu towns to contribute to the move towards containing the virus. In general, the bank has contributed more than ETB 310 million to combat COVID-19 considering forgone interest incomes on the reduced interest rates due to the virus’s impact in certain business sectors.

In addition to that the bank supports several associations and organizations working in different areas of community health. The bank has taken several initiatives in the awareness creation of Autism, Epilepsy and several other public health concerns

The impact of education to inclusive growth of the community, the bank believes that supporting educational affairs is coherent with the mission of the bank, and thus assisting associations like responsible organs, NGO’s and other charity organizations through funding or being consistent member and partner, and others as well.

Being a consistent member, we are granting for Oromia Development Association (ODA) and capitalizing funding for the association each year.

We are also supporting school feeding projects of the Addis Ababa City Administration annually.

Furthermore, we are sponsoring research and educational summits and book authors.

Through our expanding ESG and CSR efforts, Coopbank strives to empower lives, support sustainable development, and contribute to a stronger, more equitable future for all.