News

የኦሮሚያ ኅብረት ሥራ ባንክ የአካታች ፋይናንስ አንጸባራቂ ምሳሌ መሆኑ ተመስክሮለታል።

‘የለውጥ ቀንድ’ በመባልም ተሞካሽቷል

የኦሮሚያ ኅብረት ሥራ ባንክ የ20ኛ ዓመት የምስረታ ከብረ በዓል፤ የባንኩ ደንበኞች፣ ባለድርሻ አካላት፣ የመንግስት የሥራ ኅላፊዎችና ሌሎች ተጋባዠ እንግዶች በተገኙበት በሸራተን አዲስ በታላቅ ድምቀት ተከብሯል። በክብረ በዓሉ ላይ የተገኙት የብሄራዊ ባንክ ገዢ ክቡር አቶ ማሞ ምህረቱ፣ የኦሮሚያ ኅብረት ሥራ ባንክ በሀገራችን ፈጣን እድገት ካስመዘገቡ፣ ብዙ ፈጠራዎችን ካስተዋወቁና ማህበረሰብ ተኮር ከሆኑ ባንኮች አንዱ መሆኑን ጠቅሰው፤ በስትራቴጂክ አወቃቀሩና በትራንስፎርሜሽን እሳቤዎች የ21ኛው ክፍለ ዘመን የባንክ አሠራር አርዓያ ለመሆን መቻሉን በንግግራቸው ገልጸዋል።

በሞባይል ዋሌቱ በኮፔይ ኢ-ብር በደረሳቸው 17 ሚሊዮን ደንበኞቹ በተከናወኑ ግብይቶች ብር 3 ትሪሊዮን በሚደርስ ግብይቱ የሞባይል ገንዘብ ግብይት የአፈጻጸም ደረጃው ከሀገሪቱ መሪ የሞባይል ዋሌቶች አንዱ በመሆንና በሚሰጠው ከማስያዢያ ነጻ ‘ምቹ’ ዲጂታል ብድር ከ1.2 ሚሊዮን በላይ ጥቃቅን፣ አነስተኛና መካከለኛ ንግዶችን በማጎልበት፤ የፋይናንስ ተደራሽነትን ምንነት በመለወጥ የአካታች ፋይናንስ አንጸባራቂ ምሳሌ ለመሆን ችሏል ብለዋል። የብሄራዊ ባንኩ ገዢ አክለውም የባንኩ እሴቶች ከኢትዮጵያ ብሄራዊ ባንክ ራዕይ ጋር አብረው የሚሄዱ ስለመሆናቸው አድናቆትን በመቸር ባንኩን ‘የለውጥ ቀንድ’ በማለት አሞካሽተዋል።

የአሠራር አድማሱን በማስፋት አካታችነትን ተግባራዊ ያደረገው የኦሮሚያ ኅብረት ሥራ ባንክ ‘ማህበረሰብን በማብቃት የኑሮ ደረጃውን የመቀየር ዓላማን አንግቦ፤ በላቀ የዲጂታል ፈጠራ የታገዘ ዲጂታል ትራንስፎርሜሽን ዕውን በማድረግ ላይ መሆኑን በንግግራቸው ያስታወቁት የባንኩ ዋና ሥራ አስፈጻሚ አቶ ደርቤ አስፋው፤ ቴክኖሎጂ ላይ ኢንቨስት በማድረግ የማህበረሰብ ችግር ፈቺና አኗኗርን አቅላይ ዲጂታል አገልግሎቶችን ተግባራዊ ለማድረግ በቁርጠኝነት እየተሠራ መሆኑን ተናግረዋል።

ባንኩ ራዕይና ተስፋን ለሰነቁ ሥራ ፈጣሪዎች በ’ምቹ’ ብድር ያለማስያዣ የሰጠው ብር 20 ቢሊየን፣ በፋርም ፓስ የተከናወኑት ከ440 ሚሊዮን ብር በላይ መጠን ያላቸው ግብይቶች፣ ለገንዘብ ቁጠባና ብድር የ/ኅ/ሥ ማህበራትና ዩኒየኖች ዲጂታል አሠራርን ያስተዋወቀው SACCO–Link ትግበራ፣ በዘመናዊው ATM በአጭር ጊዜ ከ6 ቢሊዮን ብር በላይ ተቀማጭ ገንዘብ ገቢ መደረግ፣ በዲጂታል ቴክኖሎጂ ፈጠራ ማዕከሉ በባንኩና ከሌሎች አጋሮች ጋር በጥምረት በርካታ አገልግሎቶች በመበልጸግ ለአገልግሎት ዝግጁ መሆን፣ የስማርት ቅርንጫፎች ሥራ ላይ መዋል፣ ከአካባቢ ተፈጥሮ ጋር የተዋደዱት በታዳሽ ኃይል የሚሠሩ ኢኮ ቅርንጫፎች መስፋፋት፣ ፈጣንና በአነስተኛ ክፍያ አገልግሎት የሚሰጡ እንደ ፋስት ፔይና ለሀገራችን የመጀመሪያው የሆነው በብሎክ ቼን ቴክኖሎጂ የታገዘው ኮፕ ሬሚት ተግባራዊ መሆን፤ ባንኩ በዲጂታሉ መስክ ያሳየውን እመርታ የሚያረጋግጥ መሆኑ ታውቋል።

በአሁኑ ወቅት በከፍተኛ ፍጥነት በማደግ አጠቃላይ ሀብቱ ብር 189.4 ቢሊዮን የሆነ፣ የተቀማጭ ገንዘብ መጠኑ ባለፉት 9 ወራት ከተሰበሰበው ብር 52.3 ቢሊዮን ጋር ብር 169.45 ቢሊዮን የደረሰ፣ 14.5 ሚሊዮን ደንበኞች ያሉት፣ የ745 ቅርንጫፎች ባለቤት፣ የ15,000 ዜጎች አሰሪ የሆነ ግዙፍ ባንክ ለመሆን ችሏል።

ባንኩ ‘የፕሮጀክት 20 ለ 20ኛ ዓመት ክብረ በዓል’ በሚል መጠሪያ በተለያዩ ማህበራዊ ጠቀሜታ ባላቸው ክንዋኔዎች ለአንድ ወር ሲያከብር መቆየቱ ይታወቃል።

Coopbank Celebrates 20 Years of Impact with Grand Environmental Cleanup Campaign

March 9, 2025 – Ethiopia – To commemorate its 20th anniversary, Coopbank proudly launched the Grand Cleaning Campaign as part of the Project 20 for 20 initiative. This impactful event underscores the bank’s strong commitment to both the environment and the communities it serves.

During the event, Coopbank CEO Ato Derbie Asfaw emphasized the bank's commitment to making a positive impact. He noted that Coopbank strongly believes clean environments are essential for healthier communities and expressed pride in taking action on this important cause. As the bank celebrates two decades of progress, Ato Derbie reaffirmed Coopbank’s dedication to driving meaningful change and fostering a sustainable future for all.

Over 3,600 Coopbank employees from the Headquarters, Districts, and Branches across Finfinne City united for a large-scale environmental cleanup, with teams working in both Finfinne and surrounding areas. The event saw participation from Coopbank leadership, including CEO Ato Derbie Asfaw, as well as senior leaders and government officials, emphasizing the collective responsibility for a cleaner, healthier environment.

Bole Subcity CEO, Adde Alemtsehay Shiferaw, praised Coopbank’s commitment, stating:

"Coopbank’s dedication to community service goes beyond financial support. Their active involvement in environmental and development projects is a true reflection of their role in shaping a sustainable future for our society."

The Grand Cleaning Campaign is just one of many initiatives Coopbank is undertaking to celebrate 20 years of growth, empowerment, and community impact. By engaging its entire workforce and collaborating with local leaders, Coopbank continues to build on its legacy of social responsibility and environmental stewardship, ensuring a cleaner, greener future for generations to come.

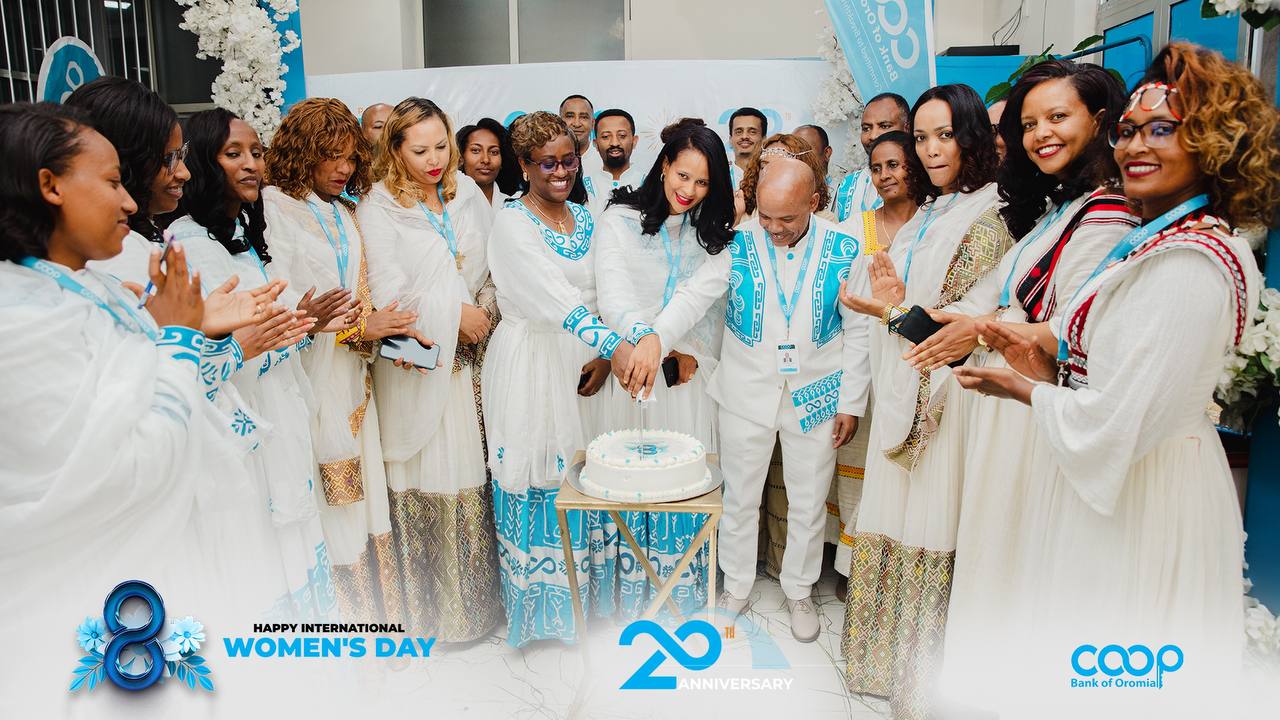

Coopbank Celebrates International Women's Day on March 8 with Colorful Celebrations

March 8, 2025 – Coopbank marked International Women’s Day with vibrant celebrations, reaffirming its commitment to empowering women. This year, the celebration took place at the Sinqe branch, where the entire team is composed of female employees. The event was graced by Coopbank’s Executive Management, including CEO, Along with branch managers from across Finfinne and the surrounding areas.

The highlight of the event was an inspiring speech by Adde Lense Geleta, Coopbank’s Vice President of Growth and Operations. She shared her personal journey and motivated the attendees, emphasizing Coopbank’s ongoing dedication to supporting and empowering women.

In his remarks, CEO Obbo Derbie Asfaw recognized the crucial role women have played in Coopbank's growth and success over the past two decades. He acknowledged the significant contributions of women to the bank's achievements and emphasized that women's empowerment continues to be a central focus of the bank's strategy. As part of its newly implemented approach, Coopbank has made empowering women one of its key pillars, with a particular focus on supporting women in leadership roles.

This year’s celebration was extra special, coinciding with Coopbank’s 20th anniversary. The event at the Sinqe branch brought together all women staff and guests to celebrate both International Women’s Day and the bank’s milestone, showcasing Coopbank’s commitment to growth, empowerment, and community impact.

Coopbank Celebrates 20 Years of Empowering Its Communities

March 2025 – Addis Ababa, Ethiopia – Coopbank is proudly marking its 20th anniversary with a month-long celebration under the theme ‘Project 20 for 20th Anniversary,’ running through March.

Since its establishment on February 29, 1997, Coopbank has been a beacon of financial inclusion, empowerment, and innovation, transforming the lives of individuals and businesses across Ethiopia. Over the past two decades, Coopbank has become synonymous with resilience, growth, and a steadfast commitment to improving lives.

With its focus on financial inclusion, the bank has ensured that even the most underserved communities have access to essential financial services. Coopbank has offered collateral-free digital loans and provided more than Birr 18.4 billion in funding to over 1.2 million accounts, empowering entrepreneurs and small businesses to grow and thrive. This support has significantly transformed lives, helping individuals build their futures and communities prosper.

Coopbank’s Coopay e-Birr service has further driven financial inclusion, reaching 14.5 million customers and processing over 2.6 trillion birr in transactions. The service has revolutionized digital payments in Ethiopia, making banking more accessible, secure, and convenient for everyone.

Innovation has been a cornerstone of Coopbank’s success, with the bank’s Innovation Center consistently developing cutting-edge digital solutions tailored to meet the needs of its customers. Coopbank’s forward-thinking approach has played a key role in shaping the future of banking in Ethiopia, making it a leader in the industry and paving the way for even greater growth.

As part of its 20th anniversary celebrations, Coopbank is engaging in several impactful initiatives that give back to the community. These include blood donation campaigns, grand cleaning programs, humanitarian visits, customer engagement events, and recognition programs. Each initiative is a testament to the bank’s deep-rooted commitment to social responsibility and its mission to make a positive difference in the lives of Ethiopians.

Looking to the future, Coopbank remains committed to empowering communities and raising the standard of living for all Ethiopians. With thousands of job opportunities created over the years, the bank continues to play a vital role in Ethiopia’s economic development. Coopbank invites everyone to join in the ongoing Project 20 initiatives and celebrate its legacy, as the bank continues to empower communities and transform lives.

Coopbank Staff Nationwide Join Blood Donation Drive to Mark 20th Anniversary

March 7, 2025 – Ethiopia – In a remarkable show of solidarity and commitment to social impact, Coopbank staff across the country participated in a nationwide blood donation campaign as part of the Project 20 for 20 initiatives. This life-saving event was held in 20 major cities, including the Head Office, in celebration of the bank’s 20th anniversary.

With the theme "Saving Lives, celebrating 20 Years!", Coopbank employees from headquarters, district offices, and branches came together to make a difference, reinforcing the bank’s values of compassion and service.

During the event, Coopbank CEO highlighted the significance of this initiative, stating:

"Our blood is renewable, but the lives it can touch are irreplaceable. One donation can impact up to three individuals, giving them hope, strength, and a second chance at life. This act of giving is a reflection of the values we uphold at Coopbank: compassion, service, and making a tangible difference in our communities."

As Coopbank marks two decades of growth and empowerment, this initiative underscores the bank’s unwavering commitment to giving back to society. The success of the blood donation drive not only strengthens the culture of social responsibility within the bank but also inspires others to contribute to life-saving causes.

Yaa'ii Ariifachiisaa 11ffaa fi Yaa'ii Waliigalaa 20ffaan Abbootii Aksiyoonaa – Mudde 19, 2017

Baankiin Hojii Gamtaa Oromiyaa, Yaa'ii Ariifachiisaa 11ffaa fi Yaa'ii Waliigalaa 20ffaa Abbootii Aksiyoonaa, Magaalaa Adaamaa Galma Abbaa Gadaatti gaggeesse.

Taatee guddaa fi seena qabeessi kun, abbootii aksiyoonaa, hoggansa baankichaa fi qooda fudhattoota kan walitti fidee fi egeree gaarii bocuuf bu’uura kan kaa’eedha. Yaa’icharrattis, Gabaasa raawwii hojii baankichaa kan bara bajataa 2023/24 Dura Taa’aan Boordii Daayrektarootaa baankichaa Dr. Fiqruu Deeksisaan dhiyeessaniiru.

Haaluma kanaan, Baankichi xumura bara bajataa 2023/24 tti.

Olkaawwannaa (Deposit) dhaan qarshii biiliyoona 117.15tti gaheera.

Liqiin Sektaroota diinagdee garaa garaatiif baankichaan kennamee jiru Qarshii biiliyoona 99.40 gaheera.

Galii waliigalaa qarshii biiliyoona 19.03 sassaabuun, bu'aa gibira duraa qarshii biiliyoona 2.51 argateera.

Tajaajilawwan fedhii hawaasaa bu’uureffatee fi dhaqqabamaa ta’e dhiyeessuun baay'ina maamiloota isaa miiliyoona 13.34tti ol guddisuudhaan, baankichi baay’ina maamilaatiin baankolee dhuunfaa keessaa adda durummaasaa mirkaneesseera.

Gama Kaappitaala Aksiyoonaatiin, qarshii biiliyoona 11.16 kaffalameera.

Dameewwan dabalataa haaraa banuudhaan, walumaagalatti baay’inni dameelee baankichaa xumura bara bajatichaatti 758 qaqqabeera.

Gama dijitaalummaatiinis, dhaqqababummaasaa daran babal’isuun lakkoofsi daddabarsa (Transaction) karaa dijitaalaa waliigalaa miiliyoona 489.5 yoo ta'u, qarshiin tiriiliyoona 1.36 ittiin sochoofameera.

Toorawwan daldalaa Maayikiroo, Xixiqqaa fi Intarpiraayizoota jajjabeessuuf, karaa liqii dijitaalaa MICHUU tiin maamiltoota kuma 110 ta'aniif qarshii biiliyooma 4 ol kennuudhaan guddina diinagdee walootiif shoora guddaa taphateera.

Ijaarsa Gamoo Adaamaa Jalqabsiisuu – Mudde 19, 2017

Baankiin Waldaa Hojii Gamtaa Oromiyaa ijaarsa Gamoo Adaamaa ifatti jalqabsiise.Gamoon kun, ijaarsa ammayyaawaa fi dheerinaanis abbaa darbii 13 akkasumas beezimantii 3 qabu ta’ee akka magaalattiitti sadarkaa 1ffaa kan ta’uudha.Kunis, akka Pirojektii addaa jijjiiramaa fi guddina agarsiisuyoo ta’uu,sirna kana irratti abbootiin aksiyoonaa, miseensotni boordii fi hoggantoota garaa garaa dabalatee keessummootni kabajaa kan argaman yoo ta’u, imala milkaa’ina baankichaa keessatti tarkaanfii isa guddaadha.

Kabaja Guyyaa Waldaalee Hojii Gamtaa – Mudde 18, 2017

Baankiin Waldaa Hojii Gamtaa Oromiyaa, Mudde 18, 2017 A.L.I tti, Guyyaa Waldaalee Hojii Gamtaa 6ffaa kabajuun, gahee baankichi waldaalee hojii gamtaa deeggaruu fi guddina hawaas-dinagdee keessatti qabu olaanaa akka ta’e mirkaneesseera. Hoji-geggeessaa olaanaan baankichaa obbo Darribee Asfaawus, Tarsiimoo hojii haaraa baankichi hojiirra oolchee fi ittiinis jireenya hawaasaa jijjiiraa jiru ibsuun, gama Waldaalee Hojii Gamtaa cimsuutiinis, baankichi ga’ee isaa bahachuu fi egeree bareedaa uumuurratti akka argamu dubbataniiru.

Hoji gaggeessaa baankichaa dabalatee, haasaa kaka’umsaa hoggantootni humna jijjiirama waldaalee hojii gamtaa hedduun taasisaniiru.

Mariin paanaalii haala waldaalee hojii gamtaa cimsuu bu’uureffate adeemsifameera.

Badhaasa fi beekamtii onnachiisaan, waldaalee hojii gamtaa fakkeenyummaa qabaniif kennameera.

Ayyaanichi, baankichi qaama waldaalee hojii gamtaa akka ta’ee fi jireenya hawaasaa hundeerraa jijjiiruuf of kennuu isaa kan mirkaneesseedha.