CSR at Coopbank: Growing Responsibly

At Coopbank, Environmental, Social, and Governance principles guide our mission to deliver inclusive, ethical, and sustainable banking services. We believe in creating long-term value that benefits not just our customers, but also the communities and environment around us.

Environmental Commitment

We support a greener future by investing in renewable energy, promoting eco-friendly operations, and organizing tree-planting and environmental conservation activities across the country.

Social Impact

Coopbank is dedicated to financial inclusion, with special focus on rural, low-income, and underserved communities. Our innovative services and outreach programs help expand access to financial tools, while we also support education, health, and community development through targeted social initiatives.

Governance

We operate with transparency, accountability, and strong ethical standards, guided by inclusive leadership. Our governance practices strengthen public trust and reinforce our role as a reliable and responsible financial institution.

Coopbank’s Charitable Contribution to Babul Keyer Charity Organization

As part of Coopbank’s 20th Anniversary celebration, the Bank’s Management, in collaboration with the Coopbank Alhuda (IFB) team, visited the Babul Keyer Charity Organization. This engagement, carried out under the ‘Project 20 for 20’ initiative, involved the provision of both cash and in-kind support. The initiative reflects Coopbank’s unwavering commitment to social responsibility and its solidarity with organizations dedicated to uplifting vulnerable communities. Through such meaningful engagements, Coopbank continues to promote empowerment and sustainable change.

Coopbank’s Support for Vulnerable Children at Yetim Children Care Center

In celebration of its 20th Anniversary, Coopbank’s Management, along with the Coopbank Alhuda (IFB) team, visited Yetim Children Care Center to extend both cash and in-kind assistance under the ‘Project 20 for 20’ initiative. This visit underscores the Bank’s long-standing dedication to improving the lives of vulnerable children. By providing critical support, Coopbank aims to empower future generations and contribute to their education, development, and overall well-being—building a brighter, more secure future for all.

Coopbank’s Ramadan Relief Initiative for IDPs Across Multiple Towns

Demonstrating compassion in action, Coopbank, in partnership with its Islamic Banking Department (Coopbank Alhuda), provided essential support to Internally Displaced Persons (IDPs) across Gelan, Koye Feche, Dukem, Lege Tafo, Sululta, Arsi-Aminya, Chiro, Sebeta, and Burayu sub-cities. Organized during the holy month of Ramadan, the initiative featured street Iftar programs offering vital food supplies and aid to those in need. This humanitarian outreach exemplifies Coopbank’s mission to uplift marginalized communities—promoting dignity, solidarity, and resilience in times of hardship.

As a responsible corporate citizen, the bank and its employees are involved in various social aspects via donations and sponsorships.

- Donation of ETB 70,000,000 (Seventy Million Birr) was made for drought victims, in different parts of the region

as a responsible corporate citizen, the bank and its employees are involved in various social aspects via donations and sponsorships.

- Donation of ETB 70,000,000 (Seventy Million Birr) was made for drought victims, in different parts of the region

As a responsible corporate citizen, the bank and its employees are involved in various social aspects via donations and sponsorships.

- Donation of ETB 23.7 million was made for communities displaced from border conflicts in the year 2017.

- In-kind support of 3,200 quintals of food items was made for the people affected by the El Nino caused drought, which particularly affected southern and south-eastern parts of the country.

- Since the outbreak of COVID-19, the bank has been undertaking various measures like donations amounting to ETB 8 million and temporarily gave its buildings to Oromia Regional State in Naqamte and Kuyu towns to be used for this purpose. The bank has also waived all fees from digital banking platforms, including ATMs and Coopay (Mobile Banking) fees, LC extension fees, and made a loan interest rate reduction of up to 5%.

The bank is dedicated to creating economic value for all stakeholders, including our customers, regulatory organs, and the larger society. Specifically,

- We remain committed to driving sustainable growth in agriculture, manufacturing, trade and commerce, construction, real estate, foreign trade (import and export), among other sectors of the economy

- We will continue to support the sustainable development of society through our wide-presence in rural areas.

- We will continue playing a very constructive and meaningful role in promoting the financial inclusion of the country.

The bank is well-known in supporting various cultural orientations through sponsorships to promote culture, art and related concerns.

We have been supporting and remain committed to financial supports made for new movies, music awards, cultural festivals, and various cultural festivities.

We will continue to support such incentives for they contribute to create sustainable values for the communities

In the light of environmental protection, we believe that environmental sustainability is critical globally for the communities we serve and for our citizens. Therefore;

- We are committed to preserving biodiversity and natural resources and collaborate with those working/concerned with environmental protection

- We do business with companies that support ecological issues and ensuring their products and services in promoting environmental protection

- We also encourage and funding for NGOs and charity Organizations working on environmental protection.

- We are participating in the nation-wide tree planting campaign every year.

Coopbank Champions the Green Legacy Initiative in Adama

Following the Management Workshop in Adama, over 1,000 Coopbank management members participated in the Green Legacy Campaign, planting trees as part of the Bank’s strong commitment to environmental sustainability.

This initiative, which Coopbank also regularly carries out in Addis Ababa, reflects our ongoing dedication to creating a greener, healthier, and more sustainable future for all.

Recently, since the outbreak of COVID-19, the bank has been undertaking various measures like a donation amount of ETB 8 million and temporarily gave its buildings to Oromia Regional State in Nekemte and Kuyu towns to contribute to the move towards containing the virus. In general, the bank has contributed more than ETB 310 million to combat COVID-19 considering forgone interest incomes on the reduced interest rates due to the virus’s impact in certain business sectors.

In addition to that the bank supports several associations and organizations working in different areas of community health. The bank has taken several initiatives in the awareness creation of Autism, Epilepsy and several other public health concerns

The impact of education to inclusive growth of the community, the bank believes that supporting educational affairs is coherent with the mission of the bank, and thus assisting associations like responsible organs, NGO’s and other charity organizations through funding or being consistent member and partner, and others as well.

Being a consistent member, we are granting for Oromia Development Association (ODA) and capitalizing funding for the association each year.

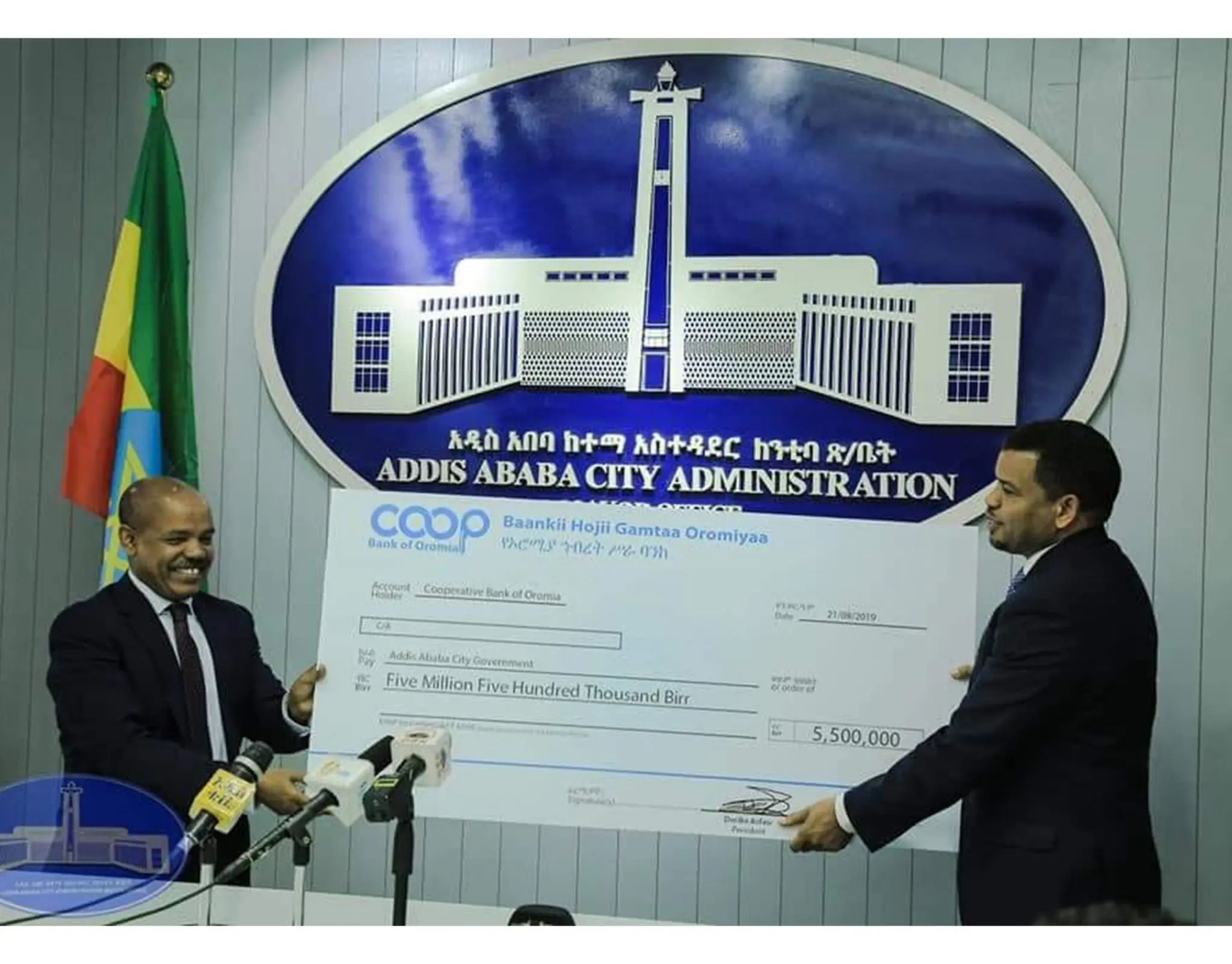

We are also supporting school feeding projects of the Addis Ababa City Administration annually.

Furthermore, we are sponsoring research and educational summits and book authors.

Through our expanding ESG and CSR efforts, Coopbank strives to empower lives, support sustainable development, and contribute to a stronger, more equitable future for all.