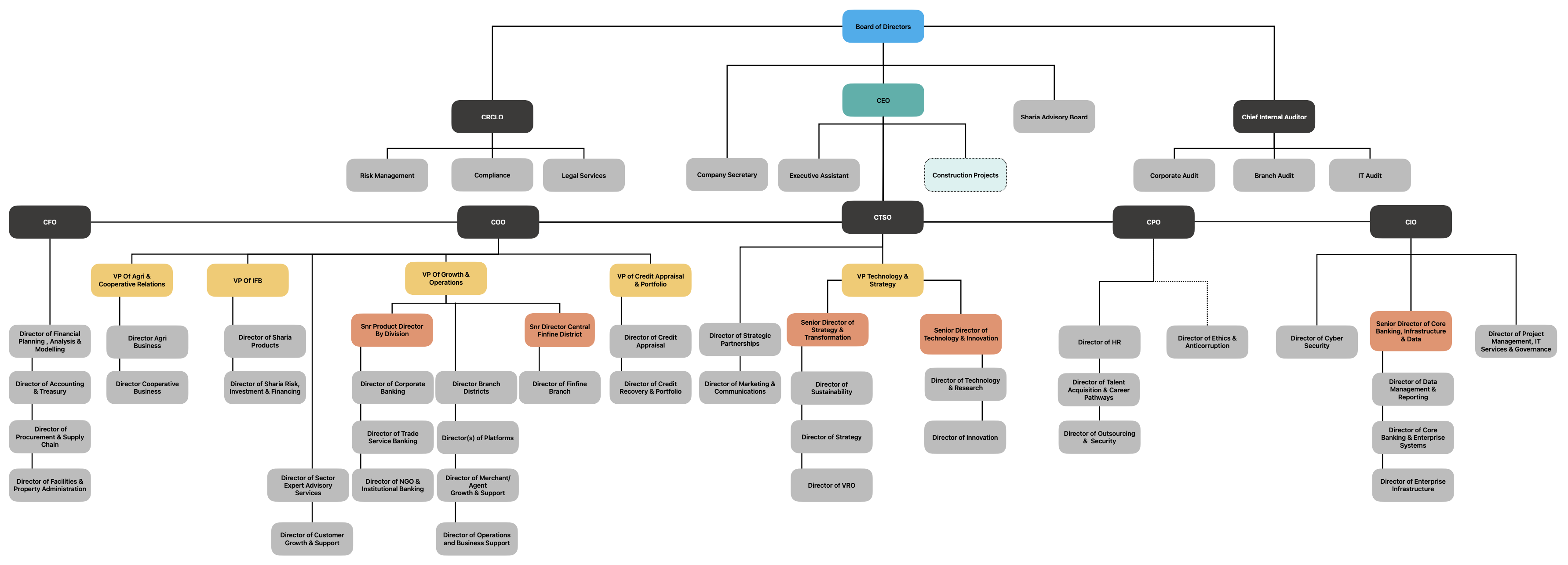

About us

Eco-Branches

Coopbank’s Eco Branch: A Sustainable Oasis in Rural Ethiopia

Coopbank’s Eco Branch – where sustainability meets financial empowerment in the heart of rural Ethiopia. Our commitment to innovation, environmental conservation, and market expansion has led us to introduce a ground-breaking concept, the Eco Branch, designed to serve communities that have long been underserved.

Connecting with Nature: Powered by Renewables:

Situated in areas untouched by traditional banking infrastructure, the Eco Branch is not just a financial hub but a testament to our dedication to environmental responsibility. Its unique design, constructed entirely from recycled containers, reflects our pledge to support environmental protection and sustainable systems.

The Eco Branch operates exclusively on renewable energy, utilizing solar technology and wind turbines. This not only ensures a pollution-free environment but also aligns with our commitment to minimizing our ecological footprint. Beyond banking services, our branch stands as a symbol of sustainable practices, harnessing the power of nature to serve our community.

Banking in Harmony with Nature:

Aesthetics and Green Development

Experienced professionals at the Eco Branch provide a full spectrum of banking services, from savings and loans to remittances and exchanges, tailored to the needs of the local community. Realizing that rural communities are the economic backbone of Ethiopia, we have strategically expanded our services to ensure that no one is left behind.

The Eco Branch is not just a financial institution; it is a catalyst for the aesthetics and green development of the surrounding villages. We believe in giving back to the community by enhancing the visual appeal of urban areas and contributing to local development infrastructure.

Extraordinary Access:

Our dedication to greener banking extends beyond infrastructure. Reaching the unreached has prompted us to introduce the "Eco-branch" innovation. Even in areas with no development infrastructure for banking services, Coopbank has pioneered this new concept to bridge the gap, ensuring financial inclusion reaches every corner of rural Ethiopia.

Sustainable Banking for the Future:

As part of our eco-friendly initiatives, Coopbank has taken the extra step to replace generators at the branch with solar energy, ensuring the sustainability of renewable energy across the board. We are not just a bank; we are a force for positive change, embracing a business model of inclusive financial services that strengthens the community economy.

Eco-Branch

Coopbank Eco-Branches journey:

Coopbank’s journey towards greener banking is not merely a response to global environmental challenges but a proactive stance to contribute positively to the communities we serve. We believe that responsible banking involves safeguarding not only financial interests but also the well-being of the planet we all share.

Market expansion

the bank demonstrates a strong commitment to community engagement. As a pivotal player in the nation's banking sector, Coopbank actively fosters economic growth and community development, solidifying its role as a catalyst for positive change.

100+

Eco-branches in remote rural areas

Coopbank's 100 Eco-branches in remote rural areas are eco-friendly branches that use modern technology to provide sustainable banking for long-unbanked communities.

753+

With a total of 753+ branches nationwide

the bank demonstrates a strong commitment to community engagement. As a pivotal player in the nation's banking sector, Coopbank actively fosters economic growth and community development, solidifying its role as a catalyst for positive change.

Join Us on the Eco Journey:

We invite you to experience banking in a new light at Coopbank’s Eco Branch. It’s not just about financial transactions; it’s about fostering a sustainable future for rural Ethiopia. By choosing the Eco Branch, you contribute to a greener, more inclusive tomorrow.

History

History

The history of cooperative banks has been traced back to the financial exclusion faced by many communities in the 19th century. With the industrial revolution, the emerging financial services sector was primarily focused on wealthy individuals and large enterprises in urban areas. The rural population, particularly farmers, small businesses, and the communities they supported, were excluded from financial services. Thus, cooperative banks were originally set up to correct this market failure and to overcome the associated problems of asymmetric information in favor of borrowers.

In respect of Ethiopia, the country has a very low financial service coverage as mainstream financial institutions are heavily tilted towards the urban centers with good physical infrastructure, leaving the rural areas underserved. Traditionally, ‘Equbs’ and ‘Idirs’ are informal institutions that are deeply ingrained in the life communities and have also been serving financial needs of the rural society to some extent. Reluctance and low capacity of the formal financial institutions in the country to serve rural community, a demand-supply gap prevailed in financial market especially in rural areas, coupled with farmers’ awareness to be organized into cooperatives and the increasing need to finance cooperatives called for establishment of a cooperative bank. Furthermore, finance appeared to be the critical bottleneck to sustain the cooperative institutions and ultimately the farmers. It was all these glitches that initiated the inception and establishment of Cooperative Bank of Oromia.

Haile Gebre Lube, regarded as the founding father (proponent) of Ethiopia’s cooperatives, brought the idea of founding the bank for he believed that the best way to fight poverty is through cooperation. Formally establishing a project office in 2002, the bank’s formation was realized with majority of shareholders being the cooperative societies. The bank then is commercially licensed in October 2004 and commenced operations in March 2005. As there is no legal provisions that allow establishment of a cooperative bank in the country, the bank was registered in accordance with article 304 of the commercial code of Ethiopia.

The Bank has broad ownership base and diversified ownership structure. It comprises Cooperatives and Non-Cooperative members. Cooperative member includes Primary Cooperatives, Cooperative Unions and Cooperatives Federation whereas, non-Cooperative members includes Organizations, Associations and individuals.

The bank has more than 753 branch networks, 14.8 million accountholders.

The Coopbank Brand

The Coopbank Brand

Corporate Colour: Coopbank has Cyan blue as its main color and Black as secondary colour. In addition to that, there is Accent Colors which can be used to accent or contrast to the primary colour for different designs.

Core Values

Core Values

The following set of values will serve to guide the words and actions of all our employees;

- Integrity

- Customer Satisfaction

- Learning Organization

- Teamwork

- Cost Consciousness

- Concern for Community

Mission

Mission

We root our foundation in communities to provide banking solutions that create greater customer experience with emphasis to cooperatives and agro-based businesses through proper use of human resource and up-to-date technologies to maximize stakeholders’ value.

Vision

Vision

Leading the way in financial inclusion, sustainability, and community empowerment for a brighter future.

Reflections From The President

Dear Valued Stakeholders

It gives me great pleasure to present Coopbank’s Annual Report for the Fiscal year, a period marked by both significant achievements and important transitions. This report reflects the collective reports of our employees, leadership team, Board of Directors, and stakeholders who have worked tirelessly to drive the bank forward. Despite a dynamic and evolving operating environment, Coopbank continued to demonstrate resilience, adaptability, and a strong sense of purpose in advancing its mission.

The year unfolded against a backdrop of notable economic shifts in the country. In July 2024, following the foreign exchange reforms implemented under the Homegrown Economic Reform Agenda, the Ethiopian birr has been floated, a major policy move that reshaped the financial landscape. While this created both opportunities and challenges, Coopbank remained agile in adjusting its strategies to align with the changing macroeconomic environment. The banking industry also experienced growing competitions, with new entrants preparing to enter the market and regulatory reforms accelerating sector transformation.

Coopbank’s Performance in Key Metrices : The total deposits of Coopbank reached ETB 175.19 billion by the end of June 2025, reflecting the continued trust and confidence of our customers and stakeholders. This represents a significant increase of 49.54 percent compared to the ETB 117.15 billion recorded in the same period last year. The conventional banking segment accounted for 84.44 percent of total deposits, while the Interest-Free Banking segment contributed15.55percent .

The Bank’s loan portfolio reached ETB 117.13 billion by the end of June 2025, reflecting a robust growth of 18 percent compared to the previous year. This growth was largely driven by strategic lending to key sectors, including agriculture, domestic and international trade, and manufacturing, which remain central to the country’s economic development. Through targeted financing and continued support to these priority sectors, Coopbank has reinforced its role as a reliable partner in driving

sustainable economic growth.

By the end of June 2025, the Bank’s base of customers reached 14.74 million, marking an increase of 10.48 percent over the previous year with 1.42 million new accounts added.

This growth reflects the Bank’s ongoing commitment to expanding access to Financial services, strengthening relationships with existing customers, and reaching new segments through both traditional channels and enhanced digital onboarding initiatives. Coopbank reported a gross profit before tax of ETB 2 billion for the Fiscal year. Total revenue for the year reached ETB 20 billion, while total expenses amounted to ETB 18 billion. As of June 2025, the Bank’s total capital reached ETB 17.46 billion, reflecting a strong and stable financial foundation to support ongoing growth and strategic initiatives. This level of capitalization positions Coopbank well to navigate market challenges, support its expanding portfolio, and continue delivering value to its

shareholders.

During the Fiscal year, the Bank expanded its physical and digital presence to enhance customer convenience and Financial inclusion. The bank’s branch network by the end of June 2025 reached 753, of which 577 (76.6%) serving regional and remote communities. Among these, 69 eco-branches provide services powered by solar energy in rural areas. Additionally, over 500 smart branches now offer voucher-free withdrawals, deposits, and money transfers through dedicated tablets and QR

codes scanned via smartphones, processing more

than 6.45 million transactions during the year. Coopay E-Birr further strengthened the Bank’s digital footprint, now supporting 207 thousand merchants and 36.4 thousand agents nationwide. These initiatives underscore Coopbank’s commitment to leveraging technology to improve service delivery, expand Financial inclusion, and engage effectively with both individual and institutional

customers.

Coopbank has continued to lead Ethiopia’s digital Financial transformation through its groundbreaking Michu digital lending platform. As a pioneer in digital lending, Michu has expanded access to finance for micro, small, and medium-sized enterprises (MSMEs) while accelerating digital inclusion. The platform assesses both risk and growth potential, enabling informed, data-driven lending decisions and effectively addressing the challenges of MSME financing in the country. In the Fiscal year, Michu served customers across 1.5 million accounts, of which 54.62 percent of total disbursements were made to female clients, with a total of 21.76 billion

birr in loans disbursed. The platform’s impact has also been recognized at the highest levels.

Major Milestones

This Fiscal year, Coopbank marked its 20th anniversary with a landmark achievement through Project 20 for 20, reflecting the Bank’s spirit of “We Play to Win” and its unwavering commitment to empowering communities and transforming lives. The initiative set an ambitious target of ETB 20 billion in incremental deposits, which was surpassed with a historic ETB 25.3 billion realized during the anniversary month. This milestone stands as a testament to the power of teamwork, dedication, and a customer-centric approach, with every branch and department contributing to the Bank’s success.Coopbank advanced several significant construction initiatives during the fiscal year, the Coopbank Business City (CBC) is set to become Ethiopia’s largest mixed-use complex. Consultant engagements have been finalized, and pre-construction activities, including site clearing and river diversion, are progressing as planned. In addition, the Adama Office Building project has completed initial works such as excavation and installation of shoring piles, with groundwork now actively progressing. The

Harar Office Building is advancing steadily, the project now has entered its final phase, with only finishing works remaining before completion. Coopbank continues to harness innovation to enhance operational efficiency and deliver ground breaking services. Within our innovation hub,several solutions have been developed to automate

internal processes, including CoopStream, which digitizes the entire loan lifecycle from origination to approval, significantly reducing operating costs and improving efficiency. These initiatives reflect Coop bank’s commitment to staying at the forefront of technological advancement, continuously innovating to anticipate customer needs and shape the future of banking in Ethiopia.

Looking ahead

Coopbank remains committed to sustainable growth, environmental, social, and governance(ESG) excellence, and deepening its impact across Ethiopia’s financial landscape. The Bank will continue leveraging technology to enhance customer experience, expand financial inclusion, and strengthen operational efficiency, while integrating ESG principles into its core operations and strategic initiatives.

Key programs, such as digital lending through Michu, and partnerships supporting the agricultural and cooperatives, and MSMEs will remain central to our mission of empowering communities and transforming lives. Coopbank will also maintain prudent risk management, robust governance, and operational discipline to navigate evolving economic conditions, growing competition, and regulatory developments. On behalf of the management team, I sincerely thank our valued customers, the National Bank of Ethiopia, partners, and all stakeholders for their unwavering support, trust, and collaboration. With our dedicated team and clear vision, Coopbank is well-positioned to

seize future opportunities, deliver long-term value to stakeholders, and contribute meaningfully to Ethiopia’s inclusive and sustainable economic growth.

Thank you,

Deribie Asfaw

CEO

Awards

Awards

Coopbank has been awarded by various organs, both global and national levels, for its impact, engagement and support made in various thematic areas.