AGRICULTURAL BANKING

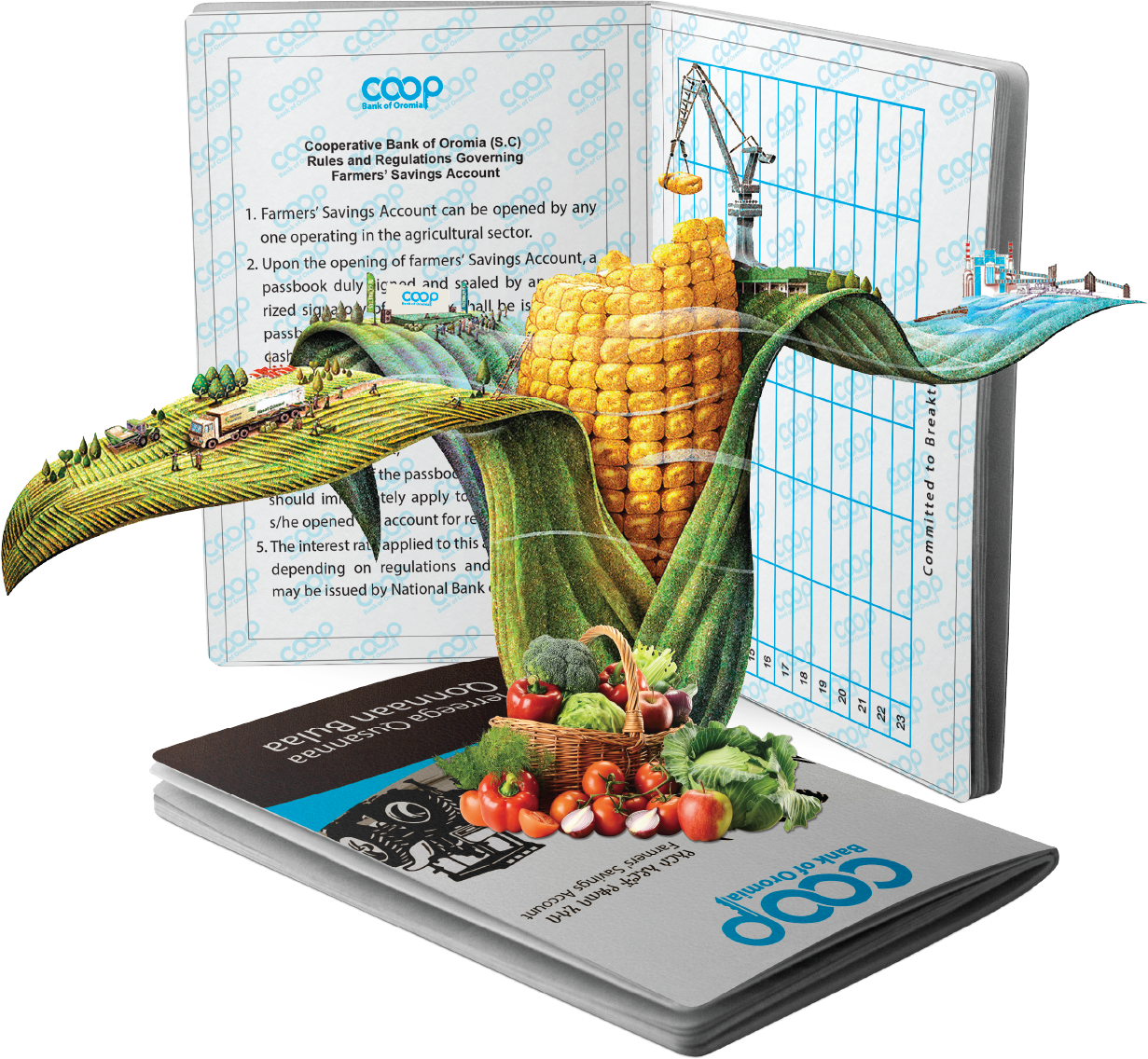

Empowering Agricultural Businesses and Rural Communities Through Exceptional Financial Services

Welcome to Cooperative Bank of Oromia – a leading private bank in Ethiopia with a strong commitment to providing exceptional financial services to our clients. With over 713 branches, including innovative eco-branches made of used shipping containers and powered by renewable energy, we are dedicated to serving over 10 million customers worldwide, with 80% of our branches located in rural areas.

Our total assets as of March 31, 2023, were valued at ETB 138.31 billion, with total deposits of ETB 113.14 billion. We are positioned to achieve our vision of becoming the top private bank in Ethiopia by 2025.

FEATURED SERVICES AGRICULTURAL BANKING

Coopbank of Oromia in a Nutshell

Cooperative Bank of Oromia is a leading private bank in Ethiopia that is committed to providing exceptional financial services to its clients. With over 713 branches, including innovative eco-branches, the bank serves over 10 million customers worldwide. As of March 31, 2023, the bank's total assets were valued at ETB 138.31 billion, with total deposits of ETB 113.14 billion.

Agricultural Loans

Cooperative Bank of Oromia is proud to be the leading financier of agriculture-related businesses among private banks in Ethiopia. The bank offers diverse loan categories to support business growth, such as Agricultural Mechanization Financing, Coffee Plantation, Processing & Trade Financing, Vegetables, Fruits, and Improved Seed Financing, Rural Saving & Credit Association Financing, Dairy Farming & Cattle Fattening Financing, Poultry Financing, Cereal Production & Grain Trade Financing, Export Financing Facilities, and Collateralized Commodity Financing. This year alone, the bank has disbursed more than ETB 14.69 billion in loans to support clients' business growth.

Empowering Rural Communities:

Cooperative Bank of Oromia is committed to empowering rural communities through its exceptional financial services and support for agriculture-related businesses. The bank's ownership structure is diverse, with cooperative and non-cooperative members, including farmers, being the major stakeholders in the institution. The bank's innovative eco-branches, made of used shipping containers and powered by renewable energy, are also helping to increase the bank's accessibility in areas where infrastructure is lacking, further supporting the bank's mission of empowering rural communities.

Digital Agricultural Products

Coopbank of Oromia utilizes digital technologies to empower agriculture and rural communities. Two of these technologies are SACCO-LINK and Furtuu.

SACCO-LINK integrates RuSACCOs with the bank’s core banking solution to provide digitalized financial services to the rural population. Through SACCO-Link the RuSACCOs digitalize their entire operation and able to inceease their scope of services through providing mobile banking, card banking and remittance to their memebers.

Meanwhile, Furtuu is a platform that provides precession as well as tracebility agriculture to small holder farmers. Through Furtuu all stakeholders in agriculture that includes small holder farmers, buyer, agro dealer and agronomist are linked. Hence the farmers get in kind in put financing, market linkage and agronomy services.

In addition to these technologies, Coopbank of Oromia has also introduced the Shega Fre Digital Agri Platform in partnership with Kifiya Financial Technology, which offers supply-chain financing to small holder farmers. Through this platform, small holder farmers receive in-kind input financing and agronomy services and are connected with already established buyers to ensure they do not face challenges during the harvesting season.